Covert footage unmasks epic centralization and internal chaos at Ava Labs

We now share video footage of Drew Pierson, the Director of Communications at Ava Labs, Fabio Barone, Senior Engineer at Ava Labs, and Zac Manafort, Growth Marketer at Ava Labs.

Pierson reveals how under Ava Labs, the decentralization of the Avalanche blockchain is secretly just a "dog and pony show," while Barone reveals their hidden control over the Avalanche network, and ownership of a massive portion of the AVAX token supply.

This case reveals insiders reporting on mounting internal chaos and lack of alignment at Ava Labs, and how founder and CEO, Emin Gün Sirer, is increasingly erratic, struggles with his role, continues to engage in questionable tactics, spends months at a time in Turkey where he's often unreachable, and is sometimes up all night for unknown reasons.

Arkham Intelligence, whose disinformation was promoted by the New York Times, was deeply linked to Sam Bankman-Fried

Arkham Intelligence, and its controversial leader, Miguel Morel, has been the subject of several serious earlier Crypto Leaks cases.

Morel, who hails from an organization accused of being a cult that was affiliated with effective altruism, appeared from nowhere in June 2021 to publish a "report" about the Internet Computer and its ICP token that was heavy with disinformation designed to harm the project, as the only publicly-revealed team member of Arkham Intelligence (we earlier shared convert video recordings that indicated Arkham was paid to produce their report). Publication of this report closely followed apparent manipulation of the price of the ICP token that had caused it to crash heavily, which emanated from the FTX crypto exchange operated by Sam Bankman-Fried.

Morel's unusual background, and links to cryptocurrency trading and the production of a fringe cryptocurrency, meant that mainstream media would normally have treated his report as radioactive. However, it was inexplicably promoted by Andrew Ross Sorkin, a star journalist at The New York Times, lending it credibility and greatly worsening the price crash and multiple forms of harm caused. At the time, Bankman-Fried was a leading financial donor to political causes aligned with The Times, and also a prize contact of Andrew Ross Sorkin. Through covert video recordings, we now reveal how Arkham Intelligence was also deeply linked to Sam Bankman-Fried, raising worrying new questions.

Arkham Intelligence engineer alleges exploit linked Binance user emails to private blockchain addresses

Arkham launched a controversial online service that monetizes information about the owners of cryptocurrency addresses on the blockchain, also creating a new cryptocurrency token that incentivizes third parties to dox the addresses of others. Perhaps their new token generated insufficient doxings, because they turned to another, potentially illegal method, to harvest confidential information about cryptocurrency users.

We share covert video footage of an Arkham engineer, who describes how he was threatened and cajoled into running exploits on the Binance cryptocurrency exchange, through which Arkham linked the email addresses of users to their private blockchain addresses, thereby depriving them of financial privacy.

We also share covert video footage revealing other worrying happenings at Arkham, including how it is led like a cult (which is intriguing because smooth-talking leader Miguel Morel hails from an organization accused of being a cult), and alleged violations of American securities law that caused the departure of senior executives they brought in.

Nansen's crypto industry market research on Avalanche misleads investors

Investors in crypto tokens, and corporations trying to identify partners, look to crypto industry market research to give them clear and unbiased signal on the nature and progress of networks and projects. We noticed that some crypto projects that appear important and deserving receive almost no coverage, while others that appear dubious benefit from near constant coverage extolling their virtues — even though the reports are presented as unbiased and informative in nature.

We decided to examine crypto market research on the Avalanche blockchain published by Nansen, which has continued to release glowing reports that are widely covered in the crypto press, despite our investigative journalism previously exposing patterns of highly deceptive behavior and malpractice by Avalanche leaders. Given that Ava Labs is a Nansen customer, might that influence their findings?

We share convert video footage of a senior Nansen team member that produces the research on Avalanche, to see what they really think, and what important facts they might be excluding from their reports.

The New York Times lashes out with another puff piece for a crypto villain

The New York Times has established a track record writing puff pieces for crypto villains. Most notoriously, they provided steadfast support for crypto villain Sam Bankman-Fried, which continued even after his devastating crimes came to light. Their loyalty derived from Bankman-Fried's massive donations to aligned political causes.

In their latest puff piece, The Times tries to rehabilitate the notorious disgraced crypto lawyer Kyle Roche, who we previously sensationally exposed using convert video footage. On the video, Roche explains in detail how he and his partners were granted Avalanche blockchain tokens and stock (determined to be worth hundreds of millions at the time of interview) by Ava Labs and their leader Emin Gün Sirer, aligning them to weaponize the American legal system against rivals, and use widespread legal attacks to draw the SEC and CFTC away, among several corrupt activities.

Since then, Roche's law firm, Roche Freedman, has been kicked off its cases by US federal judges who used depositions to elucidate the facts, and has now been disbanded. However, in their article, The Times platforms claims by Kyle Roche that are unsubstantiated, transparently self-serving, and defame those he accuses of being behind his downfall — despite Roche being a self-described liar, and despite the damning verdicts of judges.

We break apart The Times's latest crypto villain puff piece, lay bare the deceptions employed, and uncover what looks like a shocking hidden purpose born of financial self-interest that makes a mockery of the journalistic ethics The Times purports to hold dear.

Avalanche Bridge launders $300M of North Korean and other tainted crypto

Ava Labs operates the "Avalanche Bridge," which takes custody of crypto assets hosted on other blockchains, returning wrapped copies that can be used with DeFi services hosted on Avalanche. The bridge uses centralized trust, and for reasons we explore, has become a primary mechanism enabling the laundering of North Korean, Russian spy, and other tainted assets. Our case shares publicly verifiable blockchain data that strongly indicates that almost $300M of assets from such sources, much of which was previously stolen, has been deposited into the bridge.

It is unknown how much of this still remains within the pool of assets that Ava Labs maintains for the bridge. In current times, when government regulators and enforcers are looking hard at crypto, it is not knowable whether authorities may wish to seize this pool of assets and/or initiate enforcement proceedings against Ava Labs and its centralized systems. In the mean time, honest retail investors using Ava Labs' centralized bridge, may unwittingly receive tainted assets in place of those they deposited, potentially subjecting them to loss or the inability sell them.

This case does not share covert video footage. Instead, we focus on sharing the comprehensive and publicly verifiable tracing of blockchain assets from North Korean hackers, Russian spies, and others, into the Avalanche Bridge.

Ava Labs (Avalanche) has 1000s of astroturf bots that pump AVAX tokens, slander rivals, and mislead its community

Ava Labs operates a highly organized and massive secret bot and trolling army that distorts social media discourse by using fake people to parrot messages that help their cause en masse — to encourage the purchase of AVAX tokens, amplify falacious themes, insert fake consensus into their own community, and relentlessly slander rivals.

In our new covert video, we share a conversation with a leading ex-engineer from Ava Labs, who worked at the heart of their operations. He reveals their use of "astroturf" social media accounts. We additionally peform deep empirical analysis — and share the data — that reveals the true scale of their bot army, and the nature of its activities.

Why Sam routinely manipulated token prices using FTX and Alameda

Sam took a tremendous gamble in which he stole customer assets deposited into his FTX crypto exchange, and then invested them into the ecosystems of blockchains in which he held major stakes, crooked loans to himself, and influence peddling. He had to make sure the investments he made with the stolen assets succeeded, so he could repay what he stole before discovery, or face the law. A key part of his strategy was to use Alameda Research, his hedge fund and market maker, and the FTX exchange, to widely manipulate token prices. He artificially boosted the price of some tokens to justify their use as collateral he could swap for customer assets, and attacked competitive ecosystems that might disrupt his investments, often by crashing the value of their tokens.

Our new spy video captures a conversation with the Head of Settlements at FTX.US, who confirms goings on, and gives a sense of the full corruption that was occurring at the heart of Sam's empire. She also opines on why Sam claims FTX.US was solvent, perhaps explaining the massive transfer of funds from FTX International to FTX.US just after he was arrested.

Ava Labs (Avalanche) attacks Solana & cons SEC in conspiracy with bought law firm, Roche Freedman

Ava Labs is the for-profit company that develops and promotes the Avalanche blockchain. It is led by founder and CEO, Emin Gün Sirer. Roche Freedman is a law firm that widely sues organizations and individuals in crypto, including using several dozen class actions. It is led by founding partner, Kyle Roche. Ava Labs entered into a pact with Roche Freedman, after giving their key executives AVAX tokens from the Avalanche blockchain, and Ava Labs stock, now worth hundreds of millions of dollars.

According to Kyle Roche himself, this aligned them in an aim to increase the value of AVAX, and is behind an ongoing conspiracy to use the legal system to harm Ava Labs competitors, share "expertise" gleaned from confidential information obtained through legal discovery processes, pursue the personal vendettas of Emin Gün Sirer himself, and con regulators by directing them towards other projects and away from themselves. Emin's own lawyer Kyle Roche does all the talking in shocking convert video footage...

Why did The New York Times promote a corrupt attack by Arkham Intelligence?

On June 28th, 2021, Arkham Intelligence published the "ICP Report," which essentially claimed that the Dfinity Foundation, which contributes technology to the Internet Computer blockchain, executed a "rug pull" after the network underwent genesis. They claimed that they had not been paid to produce the report. Both this claim, and the claims of the report, were false.

The report was published in concert with The New York Times newspaper, causing billions of dollars in damages to holders of the Internet Computer's native token, ICP, and harming its ecosystem and community. We investigate what was behind the report. The evidence collected reveals the shocking extent of The New York Times's culpability, and how mainstream media has been dragged into crypto corruption.

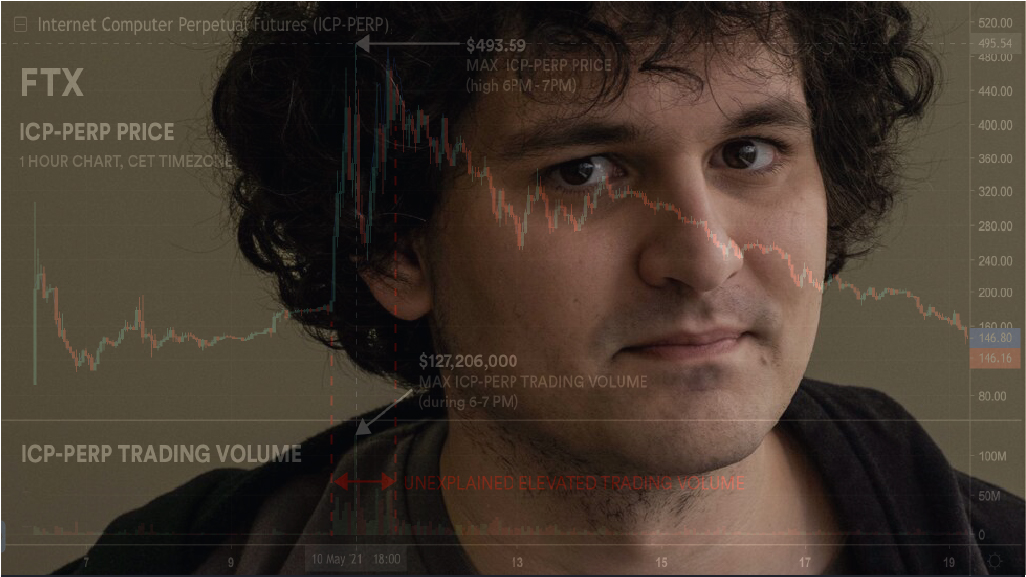

Were mass attacks on ICP initiated by a master attack — multi-billion dollar price manipulation on FTX?

May 10th, 2021, the Internet Computer blockchain underwent network genesis. This made its ICP governance token transferrable and it became available on spot markets hosted by crypto exchanges. In early trading, the fully-diluted market capitalization of ICP exceeded $200 billion. However, those purchasing ICP were unaware that its initial price had been dramatically inflated using the ICP-PERP futures instrument on the FTX crypto exchange. Once the price manipulation ceased, the price of ICP began a dramatic fall. This fall damaged the reputation of the Internet Computer and triggered other attacks that made the falls self-reinforcing. This caused tens of billions of dollars damage to the Internet Computer ecosystem and ICP token holders.

Our report investigates goings-on, and examines possible motives for the price manipulation, including whether it might have been used to disrupt the Internet Computer ecosystem to pave the way for Solana, and deliver billions of dollars in extra capital gains to holders of its SOL token. Sam Bankman-Fried has the trading logs for ICP-PERP in his possession, which must be shared to reveal who was behind the manipulation.