Update, April 7th 2023 (case published June 9th 2022): When we published this inaugral case, after considerable journalistic work, it was the first article to raise serious and legitimate questions about Sam Bankman-Fried, and a) the cojoining of Alameda Research, his hedge fund and market maker, with FTX, his crypto exchange, b) his and others' possible criminal involvement in the manipulation of a major crypto token, and their motives, c) to highlight previous accusations of price manipulation, which he had paid to go away, d) to raise concerns about how he heavily promoted his charitable actions and intentions via effective altruism, which likely relfected a strategy and desire to deflect critical examination of his own motives and behaviors, and e) his influence peddling and manipulation of the American media, political and regulatory system.

In the future, we invite investigative journalists, who are interested in obtaining the truth, to join us in our quest, to dig and uncover important information that is not being reported to the deteriment of the crypto industry and society generally. Uncomfortable information should never be ignored because it contradicts a popular narratives pushed by special interests. Crypto Leaks' Case #1 stands as testimony to how hard it can be to blow the whistle.

Key findings

- The Internet Computer is a public blockchain that extends the internet with "serverless cloud" functionality that enables it to function as alternative to traditional IT, such as centralized cloud services and database servers.

- The network transitioned from testnet to maintnet May 10 2021, which made its native ICP token transferrable, enabling the creation of spot markets around the world.

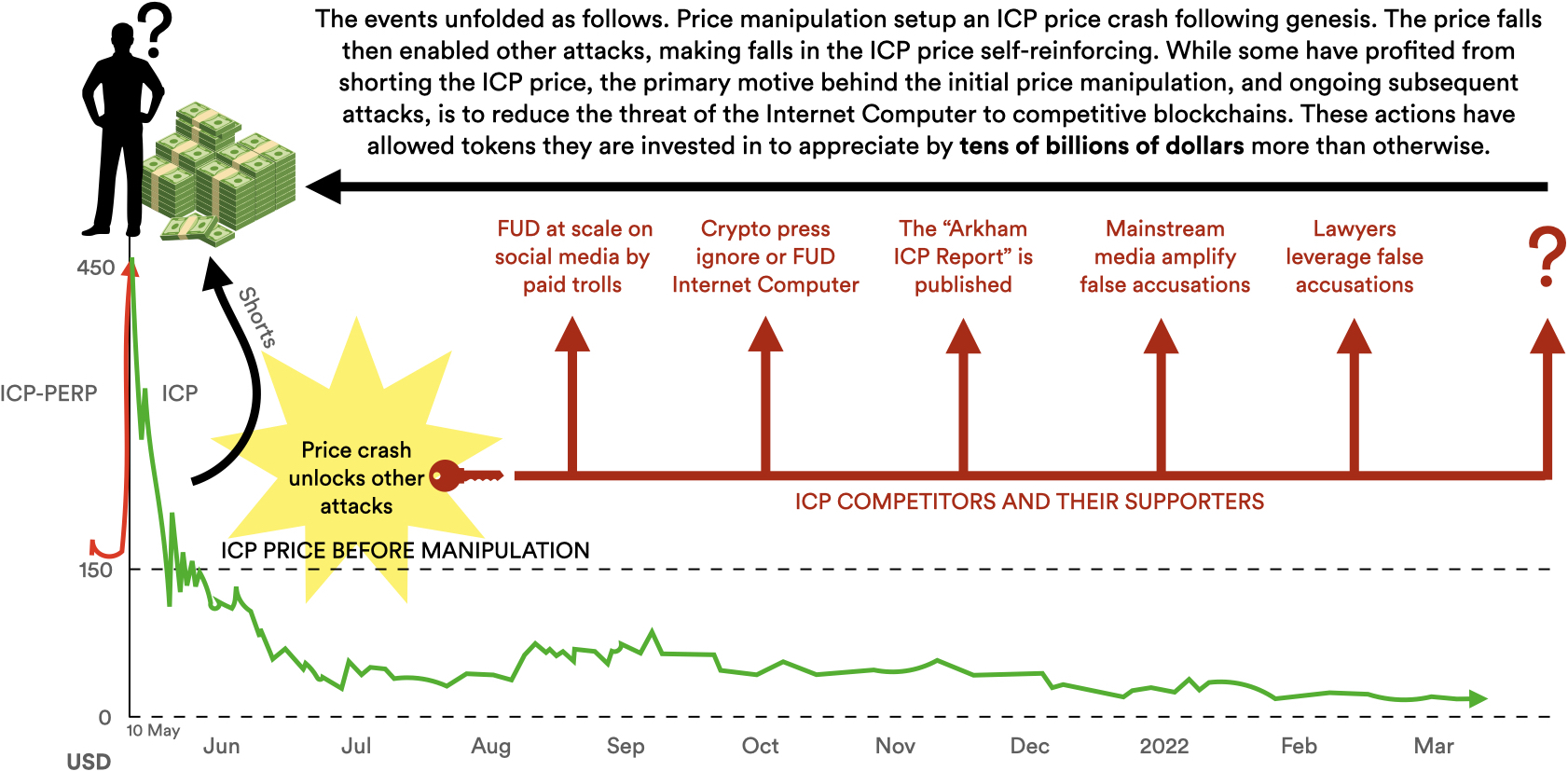

- At launch, the fully-diluted market capitalization of the ICP token was $230 billion dollars, and its price almost immediately began to crash, causing controversy that harmed the reputation of the network, and resulted in numerous attacks directed at those involved in developing the network, which we detail, causing further self-reinforcing falls.

- The spot markets were manipulated from before launch using a perpetual futures instrument called ICP-PERP hosted on the FTX exchange, run by Sam Bankman-Fried.

- We believe that the price was manipulated primarily to cause it to crash on launch, with the purpose of causing a scandal and turning people away from the Internet Computer project.

- The Internet Computer project was targeted because it threatened to disrupt other blockchains in which other parties had multi-billion dollar blockchain holdings.

- We draw attention to the vertical integration between Alameda Research, FTX and Solana, which could not exist in traditional finance.

- We present evidence of Sam's previous manipulations of token prices by drawing attention to lawsuits.

- We draw attention to influence peddling by Sam, which he uses to gain personal support and validation from organizations such as The New York Times, including his promise to donate more than $1 billion in campaign contributions in America.

- We demand that given the evidence available, Sam Bankman-Fried denies these suspicions and shares an analysis of the ICP-PERP trading logs.

- No response has been forthcoming.

ICP Price Manipulation

The Internet Computer blockchain (https://internetcomputer.org) was spun out as part of the public internet in a network "genesis" event, 10th May 2021. It had been under development for many years, which task was led by a large and well-qualified team at the Dfinity Foundation, a Swiss not-for-profit organization. They claimed that the Internet Computer's technology allowed it to fulfill the role of a "World Computer," which could host and run mass-market social media and games services, and enterprise systems, completely on the blockchain itself, without any help from traditional centralized technology, such as Big Tech's cloud computing services. The event made existing balances of its native ICP governance token transferrable on its ledger, and crypto exchanges around the world began to create spot markets where their users could buy and sell ICP.

At network genesis, and for a few hours afterwards, the price of ICP stayed above $450 USD per token, giving the network a fully diluted valuation of $230 billion USD, which was indisputably high. Then the price began to fall. Eventually, this led to a range of attacks on the Internet Computer ecosystem, which made the price falls self-reinforcing, pushing the ICP price well below its natural levels and causing great harm to ICP holders, those purchasing ICP, and the community building on the network.

Spot markets normally determine the price of assets via a process of price discovery. However, it appears that the initial price on these markets at genesis may not have been set through a normal price discovery process. Just four days before genesis the FTX crypto exchange had launched ICP-PERP, a "perpetual futures" financial instrument.

Our analysis of how ICP-PERP was traded, directly before and after the Internet Computer genesis event, has identified suspicious activity that indicates that it was used to manipulate the price of ICP on spot markets, driving it dramatically higher. The manipulation occurred in a few hours before and after genesis. Once the price manipulation activity stopped, the price of ICP began to fall back towards its natural market level.

The rapidly declining price greatly harmed the reputation of the Internet Computer ecosystem, and allowed numerous other parties to attack the project, by claiming the price falls resulted from wrongdoing by project insiders (which attacks our investigations indicate were executed by parties who were either invested in competing blockchains, or had short positions in ICP). These attacks made the ICP price declines self-reinforcing, with the result that the ICP price arguably fell far beneath its natural price. In the hours after genesis, the Internet Computer network had a market capitalization of more than $230 billion USD, but this fell by more than $200 billion in the following six weeks.

In the absence of clarity about the possible price manipulation attack, suspicion could fall on innocent parties. For example, Sam Bankman-Fried is a key backer of the Solana blockchain ecosystem, and arguably the market cap of Solana benefited to the tune of billions of dollars as the result of the events that occurred. At the same time, he is the owner of the FTX exchange that introduced ICP-PERP just before genesis, apparently enabling the attack, and he is the owner of Alameda Research, an enormous combined crypto hedge fund and market maker, an organization that is more than capable of conducting such an attack. We wish to be very clear, that this does not indicate Sam Bankman-Fried's involvement (beyond creating the ICP-PERP instrument on FTX, only 4 days before genesis).

Currently, however, Sam Bankman-Fried and FTX have in their possession a log of every ICP-PERP trade that occurrred during the suspected price manipulation, and corresponding user account information. We need them to share this information so that the perpetrator(s) can be identified. This will allow the community of ICP holders to seek redress, and help prevent further attacks from taking place, which harm thousands of ICP holders.

Reasons for the price manipulation

The damage to the Internet Computer ecosystem that would result from manipulation of the ICP price at genesis would have been obvious to a major crypto player in advance. We believe that the ICP price was manipulated by such a player in order to disrupt the Internet Computer ecosystem. We do not believe the purpose was to allow insiders to sell at a higher price, as insiders are inevitably much poorer as the result of what happened. We do not believe the purpose was to allow a crypto trader to short ICP, since at genesis insufficient ICP could be borrowed to create large short positions and justify the risk (although we note however that this may not have mattered on futures markets such as FTX). In our view, this was about protecting the status quo in blockchain.

It is easy to understand the threat that the Internet Computer poses to the status quo. At genesis it had been under development for several years by a large team at the Dfinity Foundation, which includes famous engineers, computer science researchers, and cryptographers, and its technological capabilities were (and remain) highly unusual. For example, it claims to support infinite on-chain scaling on a single blockchain, smart contracts that can process HTTP requests and create interactive web experiences, efficiency that is orders of magnitude better than any other blockchain, smart contracts that can run in parallel, smart contracts that can create transactions on other blockchains, on-chain/in-protocol governance via a DAO that can update its network nodes, and a network composed of special dedicated node machines rather than cloud software instances, and more.

The disruption to the Internet Computer blockchain arguably provided some other blockchains free reign to capture token investor mind share during the 2021 bull run. Had the press and blockchain community not been focused on the falling ICP price, and instead focused on the Internet Computer's capabilities and growing community, very possibly it would have immediately disrupted the blockchain status quo. We believe that it is likely that large individual backers of tokens in competing blockchains, may have obtained additional capital gains in the billions of dollar because of the disruption to the Internet Computer ecosystem. This is what we believe was ultimately behind the manipuation.

How ICP-PERP was weaponized

Four days before Internet Computer genesis, the FTX exchange, launched ICP-PERP, a synthetic financial version of ICP made from a perpetual future instrument (essentially a contract-for-difference). Initially, the price of ICP-PERP, through which traders could bet on what the price of real ICP would be after genesis, was only USD 114.40. The price grew slowly and naturally until the day of genesis. On the 10th of May at 10am Pacific, eight hours before Internet Computer genesis, its price had risen to USD 176.89. Arguably, to that point, everything still looked normal.

Then at 11am, ICP-PERP trading volumes (i.e., the quantity of ICP-PERP bought and sold on the FTX exchange) suddenly exploded, increasing 30 to 40 times compared with the preceding days. During the 7 hours from 11am to genesis at 6pm, when the real ICP tokens got listed on other exchanges, the total volume of ICP-PERP traded reached an incredible USD 241,360,000. On average, ICP-PERP worth more than USD 34,480,000 was bought and sold on FTX every hour. Over those 7 hours before genesis, the price of ICP-PERP reached $275.67, $344.21, $329.09, $388.16, $466.22, $432.89 and $358.34 USD.

To increase the price of an asset traded on a market, manipulators often seek to create the illusion of demand, or heighten existing demand, using a number of different techniques. Sometimes, they engage in "wash trading", which means that they find ways to make sales of the asset where they are both the buyer and seller, increasing trading volumes and apparent liquidity. Oftentimes they use sock puppets, to create the illusion that different parties are involved in the buying and selling. Market manipulators can also increase the price by making aggressive purchases of the asset for a limited period of time, again to provide the illusion of demand, which then creates more demand.

The key signal that these techniques are being used is that trading volumes suddenly become elevated. This makes ICP-PERP trading volumes highly suspicious. We can clearly see in the following graph that ICP-PERP trading volumes suddenly jumped after 11am, as the price went into a near vertical rise, and stayed strongly elevated after genesis until the peak price was firmly established. Thereafter, they suddenly dropped off sharply, leaving the price to a long, self-reinforcing decline (trading volumes are shown on the graph below the price graph). The data comes from the FTX exchange itself.

Genesis occurred, 10th May 2021 at 6pm Pacific. Major crypto exchanges, such as Coinbase and Binance, then launched spot markets that allowed the public to buy and sell real ICP tokens.

It is important to understand how and why the prices of ICP-PERP and real ICP tokens mirror and track one another. If the price of ICP-PERP is higher than that of ICP, then financial traders can immediately profit by arbitraging the difference using special hedging trades, which will drive up the price of the real ICP tokens. For such reasons, the prices of ICP-PERP and ICP are linked and will always converge over time if they become uncorrelated. If the price of ICP-PERP is higher than that of ICP, and has strong support, then the price of ICP will inevitably be pulled upwards to meet it.

From 6pm to 7pm Pacific, immediately after network genesis, ICP-PERP's trading volume went into extreme overdrive. Over that one hour, ICP-PERP trading volumes reached $127,206,000 USD, which was more than 250 times higher than in the preceding days. Its price rose to an all time high of $494.29. Since this was post network genesis, ICP-PERP was now directly influencing the price on spot markets, where real ICP was traded, in real time. By setting the initial ICP price at these highs, and maintaining it there for substantial time afterwards, the manipulators conditioned those holding ICP, and those wishing to buy ICP, to believe that the opening price range was a reasonable market price.

The public had no idea that the price of ICP had been influenced using ICP-PERP on FTX, before it even became transferrable and appeared on spot markets. The last high in the trading volume of ICP-PERP was $55,914,000 USD after 5am on the 11th of May, whereupon the price of ICP reached $476.75 USD on spot markets.

Around 7am Pacific, ICP-PERP's trading volumes suddenly normalized again, and the price of ICP began to fall.

Bitcoin crash exacerbates price drop

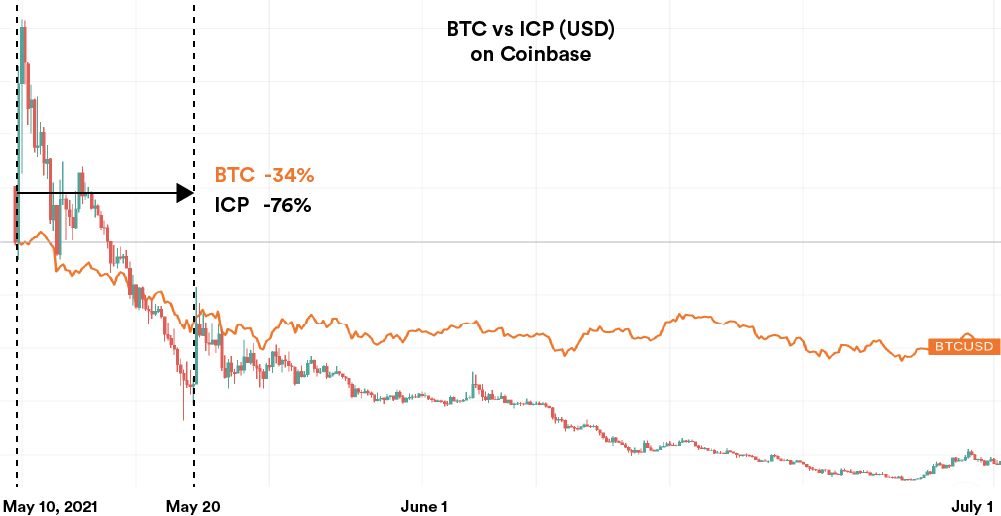

Increases and decreases in the values of most blockchain tokens are highly correlated with changes in the value of bitcoin. In the 10 days after genesis, the price of bitcoin (BTC) went into a steep decline, falling 34%. This exerted a downward pull on the price of most tokens, as can be seen from their price graphs, and this would have affected the price of ICP too. However, because the genesis price of ICP had apparently been driven 3X higher through price manipulation, such that it would have fallen anyway, the effect was magnified.

The timing was thus fortunate for the attacker, and unfortunate for ICP holders, as bitcoin caused the value of ICP that people had bought on spot markets to fall even faster than otherwise, increasing their pain. In the 10 days after genesis, the price of ICP fell 76%*. This helped the attacker unlock the perfect storm of attacks by others, which eventually made the price declines self-sustaining.

*Coinbase spot market price data. We show the sustained price high of $491 USD, not the "drop-in" price that occurred momentarily after genesis, which is shown by some data feeds.

Attacks resulting from the price manipulation

The crypto industry has long been plagued by "pump and dump" schemes. As a consequence, crypto industry participants, including investors, developers and the press, have become conditioned to interpret a dramatic rise in a token price, then followed by a price collapse, as clear evidence that insiders originally inflated the price, then sold in great numbers into market demand they generated in a kind of "rug pull" or exit scam.

If this interpretation of a project becomes widespread, it is extremely damaging, since the implication is that the project is really a charade designed to separate token buyers from their money, that the technology involved is probably unimportant, and anybody purchasing the token will probably get swindled. The attacker that manipulated the price of ICP at genesis, driving it three times higher, would have been a major blockchain player who was fully aware that such beliefs would inevitably develop about the Internet Computer when the price began to fall, diverting attention from its technology, and its disruptive potential, and how this would trigger other attacks in a self-reinforcing cycle.

The blockchain industry contains many competing tribes that are formed by token incentives. People in these tribes alternately promote (shill) the networks are invested in, and attack (troll) competitive networks that threaten their investments, using social media. Many of these shilling and trolling armies are unscrupulously directed and incentivized by the organizatons behind blockchains, as part of their marketing efforts.

As the tribes went into action against the Internet Computer, they were joined by those who had lost money trading ICP, who had been convinced by widespread claims that the ICP price must have fallen because of a "rug pull" by insiders, creating a toxic frenzy on social media.

Front-line "professional" amateurs led the trolling attacks. For example:

- False claims the Dfinity Foundation's team is fake. A troll on reddit published a report that the team displayed on the Dfinity Foundation website was fake, and they had bought fake LinkedIn profiles. Once it came to the attention of its founder, in a reply he offered a bounty to whoever would reveal the author of the report, and it was deleted (the original, unmodified report, can be found on the Internet Archive's Way Back Machine). This ridiculous and baseless conspiracy theory perists to this day, revealing how damaging this kind of defamation can be.

- Creating false truths through repetition. Joseph Goebbels, the Nazi propaganda minister, said “repeat a lie often enough and it becomes the truth”. The trolls on social media applied the same strategy. For example, Max Keiser denounced the project as a rug pull on Twitter to his half a million followers, while also shaming another party who had earlier conducted an interview with the Dfinity founder. Rug pulls claims were tweeted with false details drawn from misinformation, denouncements were published to reddit, and specially crafted videos were uploaded to YouTube. As false claims multiplied, they created a persuasive fabric of lies and disinformation.

- Fake tales of victimhood. One troll claimed to be a participant in the Dfinity Foundation's 2018 Presale fundraiser, and they had treated him shoddily by unexpectedly vesting his ICP so that they could dump their ICP on the markets before he had a chance to sell his own, making him ill through stress. Unfortunately, most readers would not have known the Presale financing round was aimed at professional investors and institutions, and they had agreed the ICP they purchased would be distributed in 12 monthly installments post genesis at the time they contributed.

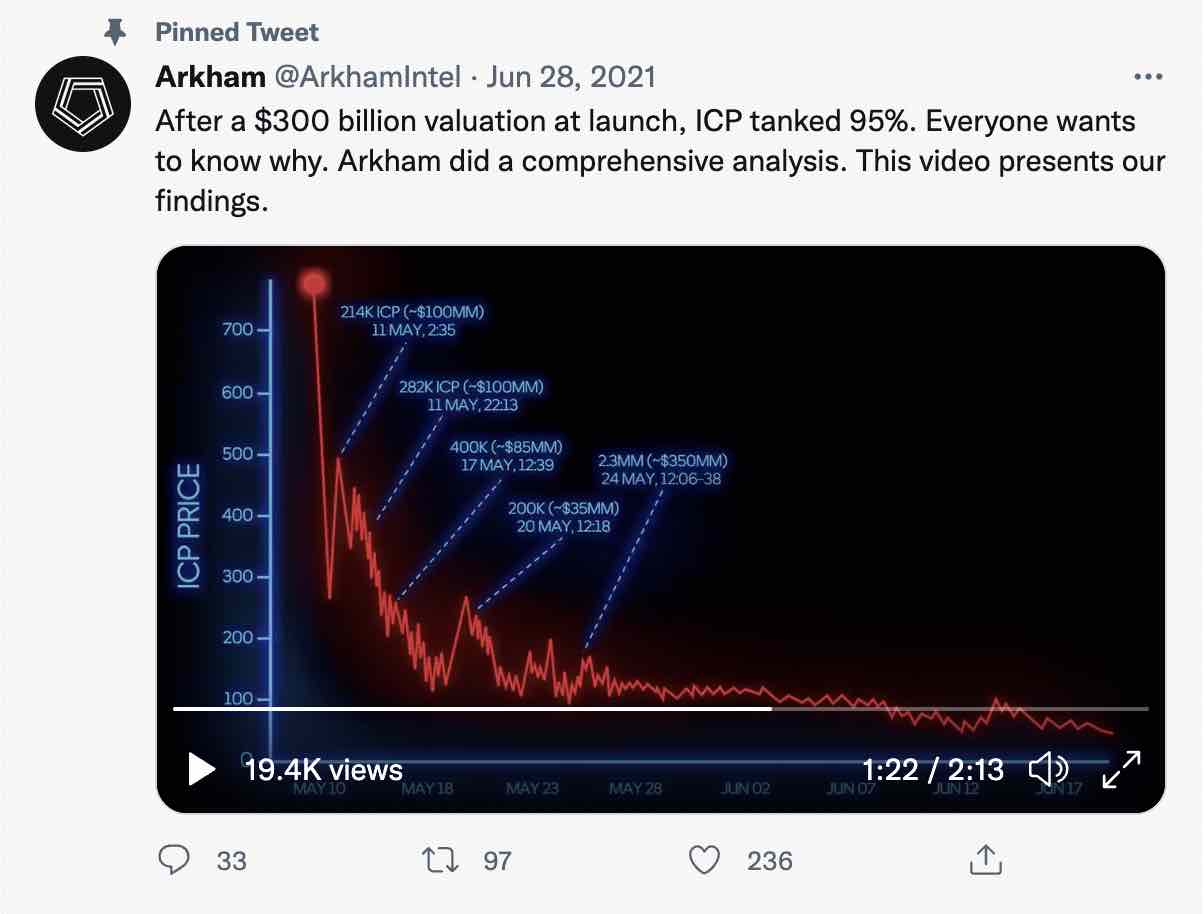

Professionally-created attacks soon appeared. For example:

-

Arkham Intelligence. June 28, 2021, a previously unknown and mysterious organization called Arkham Intelligence appeared, with an equally unknown founder and CEO, Miguel Morel, claiming to specialize in crypto industry research. They produced a report claiming to show how the price was falling because the project was a rug pull, which they promoted using a slickly-produced video. Miguel claimed that "I was not hired or compensated to release this report", presenting himself as a white knight coming to the defense of ICP holders. The video begins with a graph falsely showing the price falling from around $800, greatly exaggerating the price fall for maximum effect (some price feeds from markets show such prices, but they are only initial drop-in prices that existed momentarily).

In the video, Miguel declares that the Internet Computer network was "as large by market cap, as financial companies such as PayPal, MasterCard or Bank of America". But rather than concluding that such a high ICP price was bound to fall, he then goes on to make the case that the price fell because of insiders selling, saying: "It appears that this was not a coincidence or accident, but was a case of misconduct by those who seem closely connected to ICP, and who have been dumping billions of dollars of ICP, while smaller supporters and retail have been left in the dark, watching their investments tank", and he will "provide ICP holders with the clarity they deserve", again painting Arkham as a white knight.

Miguel Morel finishes with "we should be asking questions about what could be one of the most extreme cases of investor mistreatment in the history of crypto markets and financial markets overall". If the claims are true that the Dfinity Foundation did not sell for weeks after Genesis, and that its founder has sold less than 5% of his holdings (e.g. here, here and here) then the Arkham Intelligence report looks like professional defamation.

IMPORTANT UPDATE: Crypto Leaks Case #2 has now exposed who was behind this corrupt attack by Arkham Intelligence, and their financial motive.

Whistleblower Appeal: Do you know any more about the story behind Arkham Intelligence and Miguel Morel, or more about why this report was created? Please become a whistleblower for Crypto Leaks and support the honest crypto community.

-

The New York Times presents Arkham Intelligence as credible. The New York Times elevated the dubious report created by Arkham Intelligence, presenting it as credible, in an article published the same day, and in their DealBook newsletter, in what appears to be clearly coordinated timing. They repeatedly and erroneously referred to the Internet Computer genesis event as an I.C.O, which is illegal, creating the false and damaging impression that those behind the project were law breakers. The NYT has an illustrious history and reputation, and the credibility they lent to the Arkham claims did enormous worldwide damage to the reputation of the Internet Computer project. There can be little doubt that their irresponsible actions caused billions of dollars in additional devaluation of ICP, harming thousands of ICP holders.

IMPORTANT UPDATE: Crypto Leaks Case #2 has now exposed who and what was behind this corrupt attack by Arkham Intelligence, and looks into its promotion by The New York Times.

Whistleblower Appeal: Do you know the story behind how the New York Times was persuaded to provide a platform to Arkham Intelligence? Please become a whistleblower for Crypto Leaks and support the honest crypto community.

-

ICP Reboot - a fake community uprising. A new project calling itself ICP Reboot suddenly appeared in July 2021, claiming "ICP Reboot is a community-driven project to right the wrongs committed by dfinity's leadership. ICPR is a proper relaunch of the ICP protocol and token by forking the project to establish democratic control over this new network...". In essence, they claimed that they would take a copy of the Internet Computer's technology, and use it to launch a new blockchain with a new native token that would provide an alternative to ICP. Even though those behind the project remained anonymous, and had no reasonable claim to be able to maintain or even understand the technology involved, the claim that a fork was coming instilled fear in those holding ICP and heaped further pressure on the Internet Computer project when it was already under attack.

Whistleblower Appeal: Do you know who and what was behind ICP Reboot? Please become a whistleblower for Crypto Leaks and support the honest crypto community.

-

Class actions referencing Arkham's report appear. Two class actions appeared in the USA in July and August, essentially making the claim that ICP is an illegal security, that the price fell because of "insider selling", and that damages are therefore owed from the insiders to those who lost money trading ICP — a large share of which would go to the lawyers if they won. The lawsuits reference the Arkham report to provide evidence of wrongdoing. The first filing was by Scott & Scott from San Diego, in the state of California, and the second filing was from the controversial firm, Roche Freedman in Miami, at the federal level. These legal actions have managed to create serious additional reputational damage.

Unfortunately, it is not widely known, especially outside the USA, that its legal system makes it possible to file lawsuits replete with false and unsubstantiated allegations, without risking a defamation charge, because the contents of filings are protected speech. In addition, the accuser can then subject the accused to invasive and costly procedures, such as discovery, which allows them to obtain confidential information from the accused and disrupt them in numerous ways, even if they are completely innocent. Even if the accuser loses their lawsuit, they still do not have to pay the legal costs of those they disrupted.

In Europe, by contrast, losing accusers must pay the full legal costs of the accused, and making a false accusation in a lawsuit without sufficient evidence can lead to jail time — which naturally misleads Europeans that there must be some substance to the class action filings. Consequently, the US legal system provides the perfect platform for defaming competitors, and/or extorting financial settlements from those who wish to protect their reputations, or avoid disruption and legal costs. Both of these class actions should be viewed within this context.

Roche Freedman, particularly, appears to operate without any moral compass. The screenshot above is from the newsfeed of an Android phone. In a move that looks designed to cause damage to the Internet Computer's ecosystem, and pile pressure on those they are attacking, they first posted a paid article on the Cointelegraph website, titled Dfinity insiders alleged to have illegally sold ICP and harmed retail investors.

Roche Freedman then appears to have exploited a legal loophole: they temporarily edited the title of the article to remove the words "alleged to have", before having it indexed by Google. This caused the entirely unproven statement that "Dfinity insiders illegally sold ICP and harmed retail investors" to be broadcast to millions of people interested in blockchain via the newsfeeds on their phones, supplying the totally false and damaging disinformation that a legal judgement had been reached in their favor. Roche Freedman then reverted their paid article's title text so they could not be sued for defamation.

Whistleblower Appeal: Do you know the real story behind these lawyers? Please become a whistleblower for Crypto Leaks and support the honest crypto community.

-

The crypto press stays silent, or spreads FUD. Most participants in the blockchain industry are unaware that much of the crypto press is heavily influenced by special interests, or is pay-to-play. For example, decrypt.co provides a good source of crypto news, but is owned by ConsenSys, whose primary purpose is to promote the Ethereum ecosystem. After genesis, the crypto press fell almost completely silent regarding the Internet Computer's apparently game-changing technological advances, the Dfinity team, and the rapidly growing community of developers building dapps and services on the platform.

This helped provide the false impression to the masses and institutional investors that that the project was an untouchable scam. Articles that did appear usually highlighted the Arkham ICP Report, ICP Reboot, the class actions, and other attacks and manipulations. An example is provided by this highly irresponsible, evaluative and misleading article by CoinDesk.

-

The crypto press encourages ICP selling. Oftentimes, this involved creating webs of disinformation. For example, Brenden Rearick, whose articles were widely syndicated to different websites covering crypto, published the article The ICPR Crypto Aims to Correct the Shortcomings of Internet Computer. This presented ICP Reboot, whose team members have remained anonymous (while at the same time soliciting cryptocurrency donations in the mode of a scam) as a legitimate project motivated by the accusations of the Arkham Intelligence report. Five weeks later, he then followed up with the article 3 Cryptos Unlikely to Defrost After the Coming Crypto Winter.

Having laid the groundwork in his first article, he proceeds in his second article to argue that those holding ICP tokens should dump them on the market immediately, since the accusations made by Arkham made them risky to hold, and since exposure to the Internet Computer's underlying technology could anyway be obtained by investing in ICP Reboot — then providing a link to his first article, which promoted ICP Reboot. It seems unlikely even this crypto degen can honestly believe that ICP Reboot is a presents a genuine alternative to a network developed by an established R&D organization that is hundreds strong. However, this kind of tactic from the crypto press was very effective at misdirecting the attentions of retail investors on behalf of hidden paymasters.

Hidden conflicts of interest

THE CHARACTERS AND EVENTS DESCRIBED HEREIN ARE ENTIRELY IMAGINARY, AND USED ONLY AS PROPS TO ILLUSTRATE THE NEED FOR TRADITIONAL FINANCIAL REGULATION, WHICH DOES NOT EXIST IN THE CRYPTO FINANCIAL SYSTEM.

The traditional financial system has evolved over hundreds of years. In the past, the markets for stocks and commodities were subject to severe manipulation and scams. For these reasons, layer-upon-layer of legal protections have been created over time, which allow free markets to function correctly, and provide a measure of protection to participants from those who would steal their money or cause them unfair losses. The purpose of many regulations are to ensure that certain roles within the free market environment are fulfilled by distinct parties, who operate independently, without the ability to collude. To understand why this is important, and what appears to be going wrong within the crypto ecosystem's centralized marketplace, we can imagine a hypothetical alternative reality, in which the traditional financial markets for stocks lack these protections.

We will begin by imagining a financial entrepreneur that owned a technology hedge fund, which made money by actively trading technology stocks such as IBM and Microsoft, using clever strategies and automated systems to out-compete amateurs. The entrepreneur made so much money, that they then diversified into becoming a "market maker", which provided liquidity to the markets for stocks (market makers add depth to markets, ensuring participants can buy and sell reasonable quantities of assets near to the prevailing market price, making them essential to market functioning). A potential conflict of interest might now arise, if the hedge fund wing of the expanded business asked the market maker to disrupt markets for stock they were short on, while enhancing markets for stocks they were long on.

Now imagine further, that the combined hedge fund and market maker, made so much money together, that they also decided to launch a new financial exchange for technology stocks, which then grew to be bigger than NASDAQ, and that they all shared offices together. The potential for conflicts of interest would now be huge: the hedge fund and market maker might now ask the exchange for secret and highly confidential market information, including for information about other traders on markets, such as what stop loss orders they had made, and what their leverage was. In the absence of regulation, the potential to corrupt markets, and generate unfair profits, would be extreme.

Now imagine further still, that the combined technology hedge fund, market maker, and financial exchange, made so much money for the entrepreneur, that he decided to back a specific technology platform, whose stock would be traded on the same markets. Imagine a febrile market, like that of the dotcom boom, or crypto, where many participants are poorly informed, ensuring that financial wizardry and marketing would be far more important to market value than underlying technology involved.

Imagine the entrepreneur accumulated a massive stake in the technology platform, by making colossal investments into the company that developed the platform, and the ecosystem of other ventures being built using the platform. Imagine that his capital and control over the markets caused the platform's stock to rocket in value, providing returns that could be re-invested into the ecosystem, sucking in new investors that hoped they would be investing in the next Alphabet Inc, in a virtuous market cycle.

At this stage, the already wealthy and powerful financial entrepreneur stands to make hundreds of billions of dollars. But imagine there is a wrinkle. Another platform has been under development by a not-for-profit foundation for years, which has operated a huge R&D program, and whose technology is vastly superior and ahead of the game. There are worries that the launch of the new platform will ruin the key pitch of the entrepreneur's platform, which wishes to claim that it is the fastest, most scalable, and efficient, as it will be out-performed by orders of magnitude and lacks its new game-changing capabilities. The entrepreneur, and those who invested alongside him, stand to lose the fortune they hoped to receive.

Very clearly, it would be a reasonable worry, that with a nudge and a wink, parts of the entrepreneur's vertically integrated financial operations might decide to create trouble for the stock of the new platform — in a way that renders the competitive threat harmless for a while, providing time to suck in billions of additional capital, persuade more people to build on his platform, and generally progress his position. Who knows what the entrepreneur would do, but this is exactly why in markets involving securities and traditional commodities, regulations aim to prevent such conflicts of interest ever occurring, and crypto needs these protections too.

Sam Bankman-Fried, Inc

Arguably, potential conflicts of interest might arise in Sam Bankman-Fried's empire, which he built layer-upon-layer, creating a vertically integrated financial ecosystem.

First, Sam launched Alameda Research, which became crypto's biggest hedge fund, then additionally moving into the role of market maker, providing liquidity to crypto markets. Using extraordinary profits generated by Alameda Research's secretive and controversial trading activities, which made billions of dollars trading largely against retail investors, Sam then launched the FTX crypto exchange, which took advantage of its jurisdiction to launch myriad unusual products, growing rapidly and generating vast additional profits, providing him with colossal power over crypto markets.

Some have relayed how they have spoken to members of staff at FTX on Zoom, and had a question for Alameda Research, which has simply been relayed across the room. This co-location and intermingling of teams and roles, which are kept strictly separate in traditional finance, reflects the frightening growing potential for serious conflicts of interest to arise. Despite the risk, Sam then continued vertically integrating up the stack, by playing a leading role financing and promoting the Solana blockchain and ecosystem, whose native tokens are widely traded on crypto exchanges around the world.

Sam Bankman-Fried took his position in the Solana blockchain and ecosystem quietly, becoming by many accounts its largest investor. He then began to use his profile to widely promote Solana, without properly disclosing his position in the project. Recently, it became apparent that Sam Bankman-Fried, Alameda Research and FTX had been joined by Jump Trading Crypto — another massive combined crypto market maker and hedge fund. This was revealed when Jump voluntarily took a $320 million dollar loss to protect Solana's DeFi ecosystem after the "wormhole" bridge hack, to protect their investment in Solana and its ecosystem, reflecting the growing links between the big money players who can control and manipulate the world's crypto finanical markets, and projects whose tokens are traded there.

Sam Bankman-Fried's efforts sucked in institutional investors, who became convinced his financial might would decide the future of "Web3 technology". Solana Foundation began to offer grants of up to $10,000,000 USD to crypto projects who would build using their blockchain. At its peak, 6th November 2021, the fully diluted market capitalization of the Solana network's SOL token reached $132 billion dollars.

The potential for conflicts of interest make it essential that Sam Bankman-Fried and FTX clearly demonstrate their impartiality, by sharing the ICP-PERP trading logs, for example by sharing them with us under NDA and law enforcement in the USA and Switzerland.

FTX's tremendous recent investments into consumer-oriented advertising, including a Super Bowl ad, with a heavy focus on the sponsorship of sports, stadiums, celebrities and influencers, including Tom Brady, Major League Baseball, the Mercedes Formula One team, the Washington Wizards (NBA), the Golden State Warriors and others, makes their urgent cooperation all the more important, as retail safety must be paramount, and they deserve to trade on markets that are not manipulated.

Sam Bankman-Fried repeatedly claims he will one day give away 99% of the vast fortune he has made in crypto, creating a halo effect that often deflects criticism. But much of that money ultimately came from trading against retail investors, and he is no Robin Hood — Robin Hood took from the rich, not the poor, and gave the money away immediately.

If Sam really cares so much about benevolence, he could start simply, by helping clear up the enduring mystery of how the ICP price was manipulated using ICP-PERP by sharing the trading logs in his possession.

Troubling accusations

Taking on Sam Bankman-Fried would be no simple matter. His billions in cash and widespread influence, affords him infinite funding for legal cases, and the capacity to strike back at accusers in numerous ways. Tangling with someone widely lauded as a celebrity by the media can also invite attacks from others. Widespread adoring coverage of Sam Bankman-Fried, such as this article by The New York Times, which talks about his $21.2 billion dollar fortune, connections with supportive celebrities, his appearance on a special panel with with Tony Blair and Bill Clinton (who would have been paid to appear), and a $10 million dollar political donation to a Democratic congressional candidate in the USA, can be highly intimidating.

Now, Sam is promising to donate a minimum of $1 billion dollars to the Democrat's cause in the United States, to keep them in power at the next election, which promise will secure him many friends in high places.

But accusations have been made against Sam. In recent months, Sam Bankman-Fried and Alameda Research have been accused of manipulating crypto markets very broadly, using techniques and systems that would be highly illegal in regulated markets, and attacking a blockchain project that appears to compete with Solana, by combining market attacks on their token with FUD campaigns (something which resonates particularly strongly when considering the ICP-PERP attack and following events).

Allegations stretch back years. For example, it has been alleged that on September 2019, Alameda Research was responsible for two attempted attacks on global crypto markets using the Binance exchange, which were prevented by their anti-price-manipulation systems. The allegation was that they dumped a large volume of bitcoin futures on a Binance market to suddenly and substantially reduce the price of bitcoin around the world, with the aim of triggering bitcoin stop loss orders, margin calls and causing cascading liquidations on other exchanges.

It's alleged that Alameda Research were setup to profit handsomely, to the great deteriment of retail traders whose stop loss orders were triggered and positions liquidated. A related court case was later filed, which was closed with a voluntarily dismissed with prejudice status that often indicates the defendant paid the plaintiff to drop the case (i.e. it was settled via an out-of-court agreement). Other allegations have been made by the press, for example, here and here.

This case investigation is primarily concerned with the attack on the Internet Computer and ICP holders, which was initiated using ICP-PERP on FTX, in respect of which we are seeking the assistance of Sam Bankman-Fried and FTX in identifying the perpetrators. However, generally speaking, we do believe the world should ask more questions, and demand more information, with respect to what is acceptable practice on today's crypto financial markets.

A final note is that the financial performance of today's crypto market makers, including Alameda Research, is highly

anomalous when compared to the traditional, regulated markets.

Rumor has it that they are sitting on several billions of dollars in cash profits earned

over the past two years.

In regulated traditional markets, they would be expected to have earned a tiny fraction of that.

Ultimately, this is liquidity extracted from the crypto financial system that came in large part from retail investors.

Whistleblower Appeal: Do you know how Alameda Research really made its billions? Please become

a whistleblower for Crypto Leaks and support the honest crypto community.

Watch Anatoly Yakovenko snigger about ICP

The leaders of major blockchains that benefited from the attacks on the Internet Computer, tend to studiously avoid mentioning the network, because they want to help amplify the attacks by conveying the project is now irrelevant. However, Solana CEO and Chief Scientist, Anatoly Yakovenko, and his co-founder, can be caught talking about the network on video towards the end of an interview, about a month after genesis.

Asked to "FUD one other project" by the interviewer, Anatoly chooses the Internet Computer,

and says, while sniggering uncontrollably, "I know I kind of 'dunked on' Dfinity, right... earlier" and

"I feel bad about saying bad about anyone else" — although what he had said earlier has been edited from the video.

It is left to the reader to guess whether Anatoly was aware of what had happened with ICP-PERP.

Watch the video on YouTube, starting at 1:32:20

The threat to Solana's pitch

For Sam it's all about Web3

Web3 is the next phase of the internet, and will involve pervasive tokenization that provides people with direct ownership of assets, such as media content, and shared ownership and participation in the direct and exclusive control and governance of the online services they choose to use. An early manifestation of the Web3 trend can be seen in the worldwide NFT craze, which tokenizes simple digital assets. For many blockchain insiders, a crucial next step is for systems and services, such as social media and games, to be reimagined and fully rebuilt using decentralized technology. This will have an even more profound impact.

In the emerging model, online services, such as social media, will be placed under the full control of community governance systems, called DAOs (or, decentralized autonomous organizations), which in turn are controlled by those holding governance tokens (which make it possible to vote on proposals and updates). In the future, governance tokens will be disbursed as rewards, and enable users to become part owners of the services they use.

Governance tokens will be distributed to users to engage them and enlist their support, making them part of the team advocating for the service, and to create token incentive frameworks within which some users perform necessary tasks such as content moderation. This new user-centric ownership and control architecture, in which users become part of the team helping to sell and run services, augmented by interesting tokenization schemes, promises to make services much richer and more viral.

Arguably, the Web 2.0 ecosystem will be progressively reinvented in Web3 form. This presents tech entrepreneurs with one of the greatest opportunities in recent history, since it provides for services to be reimagined in highly compelling new ways, in which tokenization helps create powerful network effects that enable them to out-compete incumbent centralized Web 2.0 services over time, as well as create entirely new kinds of experiences.

The leading blockchains that play the role of Web3 platforms will become incredibly valuable, and this is why Sam Bankman-Fried and Solana place its Web3 capabilties and aspirations at the core of their strategy and pitch to the world. Using a blockchain to support Web3 will require that it is particularly fast and efficient, and can scale to huge throughputs, and Sam Bankman-Fried often claims this as a unique selling point for Solana. For example, at Yahoo Finance and Decrypt's Crypto Goes Mainstream conference, November 2021, Sam Bankman-Fried said:

| “ | Solana is one of the few currently existing public blockchains that has a really plausible road map to scale millions of transactions per second at, you know, fractions of a penny per transaction, which is a scale that you need for this |

Web3 blockchains will have to do much more than maintain simple token balances and run lightweight smart contract computations. In the future, it will be necessary to completely decentralize online services, and run them entirely on the blockchain, so that they can be placed under the full control of community DAOs and their governance tokens (a DAO can only update other code running on the same blockchain).

Building Web3 services using traditional centralized IT technology such as cloud services, databases and web servers, doesn't make any sense, since it cannot be placed under the control of a community DAO. Furthermore, it can also get hacked, get corrupted, and is not unstoppable like a blockchain, and the person or organization who manages it has complete control — which would extend to any Web3 service built with it, even though Web3's service of the future are meant to be managed exclusively by their community.

Sam is very aware that Web3 blockchains will need to host mass market social media services in the future. For example, at Solana Breakpoint, November 2021, Sam Bankman-Fried said:

| “ | I think social media on the blockchain — I continue to think this could be absolutely huge. I think it solves a lot of existing pain points, which are really coming to the forefront of society right now. |

Sam Bankman-Fried clearly expresses that speed, efficiency, scalability, and the ability to host social media on the blockchain itself, are core to the Solana pitch.

But aspiration and practical reality are different. What is the practical reality, and how does it compare to the Internet Computer? Would he and other Solana insiders see the Internet Computer as a competitive threat?

The yawning gap: perception vs reality

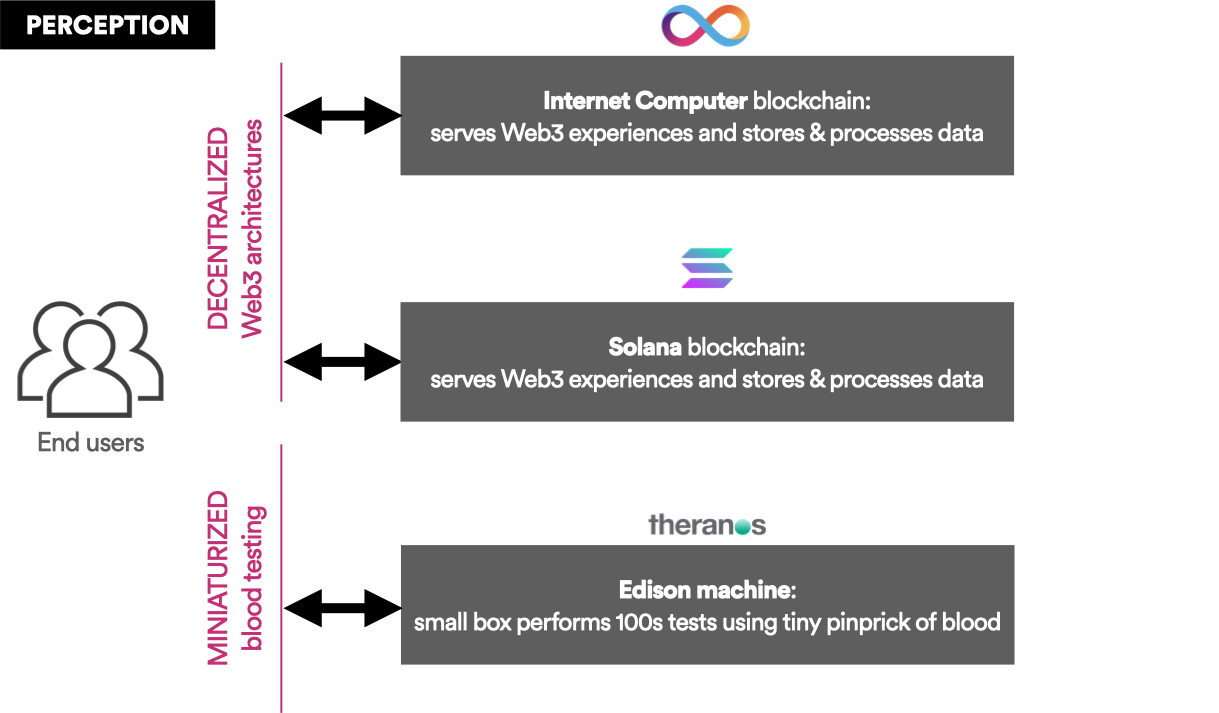

At a high level, the threat that the Internet Computer presents to Solana can easily be understood by performing a simple survey of what members of the public who are interested in blockchain, including journalists and investors, understand when they hear that a Web3 service or application (i.e. a "dapp"), has been "built on Solana". In our experience, every single person we carefully surveyed, understood the phrase to mean that the service or application is actually running entirely from the Solana blockchain, which is an end-to-end Web3 decentralized technology platform:

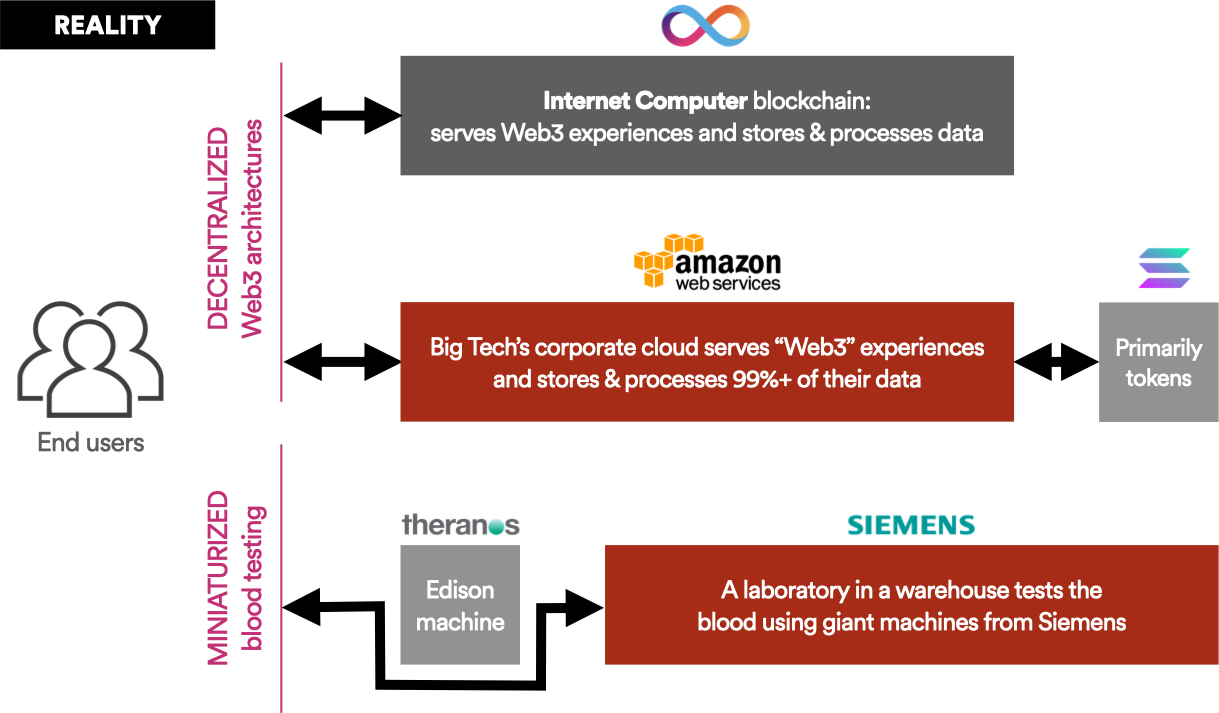

But this carefully cultivated perception is dramatically different to the reality. Web3 services and applications "built on Solana" are in fact really built on corporate cloud services, such as Amazon Web Services, or insecure server machines in data centers, which are running databases, web servers and other elements of traditional IT, and Solana is just used to maintain tokens and tiny pieces of information:

If the above diagram is surprising to you, you are not alone. The blockchain industry functions in the mode of a giant reality distortion machine, which funnels people towards projects that benefit hidden cartels of rich people who wish to sell their tokens.

You might expect that developers describing themselves as "building on Solana", while in practice building using traditional IT, would see the issue with the situation, but that's not the case. They accept the status quo, because they know no different, having been brought directly into the Solana ecosystem from the Web 2.0 space by its hype, PR and marketing, and glitzy parties, which provides them with the social proof they need to feel confident they are doing the right thing. Most did not reconnoitre the alternatives, nor understand the nuances of Web3 and blockchain, and simply started building having received generous cash grants to build on the network, which are topped up with incentive grants of SOL tokens, making them fully paid-up and locked-in members of a club vying for Solana's success.

Those behind Solana could not fail to feel insecure about this stark difference between perception and reality. As the Internet Computer neared its genesis launch, they must have feared that the Internet Computer, with its ability to host mass market social media services on-chain, which is something they covet and have publicly aspired to, would disrupt their ascension through the blockchain market cap rankings.

Aspirations vs technical reality

The vast majority of those who have invested into the Solana blockchain are unaware of the vast technical differences between blockchains. Most are convinced of the potential of blockchain and Web3, and backed Solana because of Sam Bankman-Fried's success and profile, and the comfort gained from other investors doing the same. Many would make the argument that the technical differences between blockchains are unimportant in Web3, and cite the classic example of how the VHS video format, used by JVC, beat out the technically superior Betamax format, used by Sony, during the 1970s.

The theory is that the capital and influence of Sam Bankman-Fried and his network, can easily beat out a superior technology in the short to medium term, while gaining time to bring their own technology up to par.

For example, "Shark Tank" star Kevin O'Leary,

said about Solana:

| “ | Who's working on that? Sam Bankman Fried and his team. Why wouldn't ya bet that horse? |

However, comparing the differences between the Internet Computer and Solana to differences in video tape formats has limited merit.

The Internet Computer has completely different kinds of technical capability, when compared with Solana, which are arguably crucial to enabling the Web3 revolution because they allow Web3 services to run 100% on-chain under the control of community DAOs. For example, smart contracts hosted on the Internet Computer can process HTTP requests and serve interactive web experiences directly to users, without need for cloud computing.

Even where technical capabilities can be compared, Solana's stats fare badly. For example, to store 1GB of data, Solana charges a rent of 3,480 SOL / year, which is equivalent to $348,000 / year (if 1 SOL token is priced at $100 USD). By contrast, storing 1GB of data on the Internet Computer, has a stable cost of about $5 a year, which is paid in "cycles".

The Internet Computer's developer community has already begun to leverage this lower cost to build Web3 social media services that run 100% from the blockchain. This is something that is completely impossible on Solana. Dominic Williams, the project's founder, recently claimed on video that it costs 1.6 cents to store an amount of data equivalent to a "phone photo" on its network, but thousands of dollars on Solana (in USD). This directly contradicts one of Solana's key claims, that it is the most efficient and low-cost blockchain.

A Web3 messaging service called Open Chat, which the user interacts with using a web browser, runs entirely from the Internet Computer blockchain. The service involves smart contracts on the Internet Computer that are fast enough to process instant messages, and efficient enough to store media messages. Arguably, this is an example of what Solana wants to do, and needs to support.

That the service has already grown to many thousands of users, which demonstrates that the Internet Computer presents a clear and present danger to Solana and its backers. Investors might hope that Sam Bankman-Fried's billions can keep the Internet Computer at bay while their R&D department narrows the technology gap, but it is not as simple as that, as key backers would have been very aware.

Despite all the attacks on the Internet Computer, it has a large and organically growing community of developers that by all accounts are building hundreds of Web3 projects. On social media, people are now regularly drawing attention to Internet Computer developer growth vs Solana. Imagine what the situtation would have been without the price manipulation.

Because Solana has firmly hung its hat on the Web3 race, there can be little doubt that had the ICP price manipulation not occurred, the Internet Computer would have deeply disrupted its pitch and market position.

Evidence Solana is really fake technology

There is a thesis about Solana circulating among cryptographers and distributed computing experts. The thesis is essentially that Solana is falsely advertised as a blockhain that provides security and liveness guarantees using cryptography, but is really a "federated database" that relies on Solana Labs for its operation — and that this could be confirmed as true by any suitably qualified computer science expert who was allowed or able to obtain a copy of its design. The claim is that the design of Solana is highly obfuscated for this reason.

IF THIS THESIS IS TRUE, IT SHOWS THAT THE THREAT THE INTERNET COMPUTER POSED TO SOLANA AT GENESIS WAS EVEN GREATER THAN MIGHT BE THOUGHT.

Proponents of this thesis argue that its CEO, Chief Scientist and Lead Developer, Anatoly Yakovenko, lacked a sufficient understanding of the advanced cryptography, distributed computing math, and other areas of theoretical computer science required to build a real high performance blockchain. Owing to this lack of understanding, Solana built a distributed system that is more akin to a "federated database", rather than a blockchain, which relies upon Solana Labs, Inc acting as a controller to regularly fix and reconfigure the network's state ("data") when it goes wrong. So the thesis goes, they are aware of the problem, so to prevent anybody uncovering the current state of affairs, they have decided not to share formal descriptions of how Solana works.

The great irony is that Solana's high transaction throughput relative to other blockchains (with the exception of the Internet Computer) was absolutely critical to their successful 2021 Web3 pitch — but it might only have been achieved because the network is not a real blockchain.

Constant network outages. These outages often last for a long time while Solana Labs attempts to resovle inconsistencies in the network's state in the role of a trusted intermediary, as in the 48 hour outage in February 2022 and multiple outages just before that. At the time of writing, the Solana network last went down for several hours on the 1st of June. As before, Solana Labs sent out instructions to operators of validator nodes, telling them what they must do to help them repair the network. These included specifying exactly which earlier "slot" the network should be restarted from, reflecting how Solana Labs must make decisions about which state (i.e. user data) is used after it diverges.

Refusal to share protocol math. Open networks and network technologies depend upon the protocols and standards involved being publicly specified. That is because they depend on the mathematics invovled for their security, and this must be open to review, otherwise there is no way for experts to verify that they are secure. For example, every aspect of the HTTPS protocol and related technologies such as Diffie Hellman cryptography is publicly shared. Complete formal designs explaining the workings of the Solana blockchain have not been provided.

Indications of a serious lack of expertise.

Solana project did not involve scientists and cryptographers to help with aspects of

blockchain design such as cryptography, distributed systems and execution environments

early on (unless they kept this secret, but we can't evidence of this).

Anatoly Yakovenko, its primary architect, has often indicated how he thinks that formal computer

science and math, which cryptography and blockchain protocols depend upon, are overrated.

For example, in a reddit post

Anatoly Yakovenko says :

| “ | I worked ... for over a decade. Literally from 2g to 5g r&d and commercialization. There wasn't a single research paper in sight. I worked with hundreds of Phd's, and commercialized r&d, no papers. Why wouldn't a giant corporation competing to the death to have the best in class tech care about academic research? It's because it's not practical, by definition, it's academic. Where you get outsized improvement in any parameter, performance, security, stability... is in the practical application. |

Did Anatoly draw inferences from his previous employment, and wrongly decide that formal math, normally shared in the form of papers, is not needed in cryptography and blockchain protocol design? We discovered that Dominic Williams, the Internet Computer project's founder, once drew attention to a since deleted post on reddit, in which Anatoly makes a claim about Solana that cannot possibly be true, indicating that he was unaware of basic mathematics in the field.

Solana's white paper is a sham Solana has published a single white paper, in which it describes a cryptography scheme called "Proof of History". Solana's team promoted this scheme as a revolutionary inventive step to explain their blockchain's high transaction throughput. The paper looks strange. We found a work shared on Twitter by Victor Shoup, a world-renowned and famous computer scientist specializing in cryptography and distributed computing, who works for the Dfinity Foundation, that analyzes Proof of History in depth. This appears to show formally that it is completely bogus. Certainly, to our untrained eyes, it does not look remotely like works the Internet Computer team seem to produce themselves, such as this or this. If Victor's claims are correct, and he does not seem to be the kind of person who would lie, as he has a reputation built over decades to protect, Proof of History is pure snakeoil.

Competitive threat summary

The foregoing sections make it clear that the Internet Computer potentially poses a devastating threat to Solana's pitch. If content on the Internet Archive's "Way Back Machine" is to be believed, the Internet Computer is a highly technical and authentic crypto project dating from 2015, where the concept of rebuilding the world on blockchain was first described (we cannot find prior references to this idea). Furthermore, assuming the conspiracy theory that the Dfinity Foundation's team is fake is as ridiculous as it sounds, and the team members they list are real, then the project would appear to be backed by an extraordinary team, comprising many leading cryptographers, computer scientists and engineers, many of who have earned thousands of research citations individually, and bring experience from diverse backgrounds, including from leading technology organizations such as Google Research, IBM Research, and high-flying academic institutions, as well as the crypto industry itself. By comparison, Solana does not even share details about its technical team.

A modicum of digging quickly reveals the Internet Computer is greatly superior technology, and is pursuing a far more ambitious vision for blockchain and the internet as a whole. The growth in its developer ecosystem, despite all the attacks and the lack of big money backing, shows that the network has real product/market fit.

In the absence of the market manipulation of May 10, 2021, and the devastating attacks the falling price unlocked, which framed the Internet Computer as being a dishonest project, the Internet Computer would almost certainly have deeply disrupted Solana's core claim to being the future of Web3 during the 2021 bull run. Backers of the Solana ecosystem accordingly benefited enormously.

There must be urgent action

The price manipulation attack using ICP-PERP on FTX must almost certainly have been performed by a crypto hedge fund or market maker with both the motive, and the necessary technical capabilities, and capital on markets.

In this case investigation, we have presented purely circumstantial evidence that shows Sam Bankman-Fried benefited from the attack via his positions in the Solana ecosystem. We have also shown purely circumstantial evidence that he might have had the means to perform the manipulation This of course, does not mean that he performed the attack.

In practice, several parties could fall under suspicion, which underpins the absolute necessity of Sam Bankman-Fried and FTX clearing matters up by immediately sharing the ICP-PERP trading records in their posession and revealing the price manipulator(s) who triggered the following attacks documented in this case investigation report. Identifying the perpetrators will help ensure that they cannot strike again causing more damage, and will vindicate innocent parties.

For our part, we pledge to continue investigating until this case is fully resolved, and to continue

running investigations that unmask those attacking the honest crypto community.

Whistleblower Appeal: Do you know anything about what transpired? Even small pieces of evidence can

break the case for the benefit of the world. Please become a whistleblower for Crypto Leaks

and support the honest crypto community.

Read more case investigations...

We show the public what goes on behind the scenes in crypto. If you can help, please become a whistleblower.