We collect and publish covertly filmed video footage in accordance with all applicable laws.

Key findings

- Arkham Intelligence was an unknown outfit based in the countryside outside Austin, Texas. It had no track record or history when it published the "Arkham ICP Report," June 28 2021.

- Their only known employee was Miguel Morel, a twenty-one year-old man, also without history, other than a LinkedIn profile that stated he was a cryptocurrency investor, and had previously played a role creating a fringe cryptocurrency called Reserve.

- The report claimed that DFINITY, the main developer of the Internet Computer network's technology, had performed a pump-and-dump of its native ICP token, which became liquid when the network launched May 10 2021, causing a dramatic subsequent drop in price (see Case #1 for more history on events).

- Since many aspects of their claims and data did not make sense, we investigated them, and recorded spy video of conversations with Miguel's associates and team members.

- Our investigations reveal Miguel's extraordinary links to a strange cult, based in Oakland, California, and that his close associate is an anti-Semite that celebrates Hitler's birthday.

- On spy video we record associates and team members saying that the Arkham ICP Report was produced to order as a hit piece. (The likely aim was to harm the reputation of the Internet Computer project, and thus cause the price of its ICP token drop.)

- The Arkham ICP Report was inexplicably published in concert with The New York Times, which apparently failed to check its source — indicating the involvement of a powerful third party that we predict will be revealed in due course.

- Security teams from Eastern Europe are filmed protecting holdalls filled with unknown cargo, as they are brought from taxi cabs into a mansion in Chelsea, London, UK, which became Arkham's headquarters after they published the report.

Background to June 28, 2021

The Internet Computer blockchain (https://internetcomputer.org) was spun out as part of the public internet in a network "genesis" event, 10th May 2021. It had been under development for many years, by a large and well-qualified team at the Dfinity Foundation, a Swiss not-for-profit organization with research centers in Zürich, San Francisco and Palo Alto. There was enormous excitement, since the Internet Computer network was claimed to be capable of playing the role of a "World Computer," which would provide an open alternative to traditional IT, running code that was hackproof, and which could support new forms of Web3 services, such as social neworks.

The event made existing balances of its native ICP governance token transferrable on the network, and crypto exchanges around the world began to create spot markets where their users could buy and sell ICP. At genesis, and for a few hours afterwards, the price of ICP stayed above $450 USD per token, giving the network a fully diluted valuation of $230 billion USD, which was indisputably high. Then the price began to fall.

By June 28 2021, the ICP price had reached $50 USD, giving the network a fully diluted valuation of $23.5 billion USD, which arguably was comparable to other competitive networks at the time. Then a previously unknown organization, Arkham Intelligence, led by a previously unknown founder and CEO, Miguel Morel, published the "Arkham ICP Report."

The essential claim of the Arkham ICP Report was that the Dfinity Foundation, the Swiss not-for-profit organization that is the primary contributor of the technology used by the blockchain, and related insiders, had in fact executed a scam known in crypto as a "rug pull". This would have involved DFINITY somehow setting the high initial price for its ICP governance token, so that insiders could dump large numbers of ICP tokens they held on unsuspecting investors.

However, it would highly unusual, for an organization of hundreds of renowned computer science researchers, cryptographers and engineers, to spend many years developing a network, only to undermine its prospects at launch. Furthermore, the report was full of unsubstantiated claims, inaccuracies and obvious logical fallacies. To any seasoned observer in the crypto space, it looked very much like market manipulation, designed to harm the reputation of the project, which was probably sponsored by a competitor, or financial actors wishing to short its token. Our Case #1 documents happenings at the Internet Computer network's genesis and thereafter, which appear to show how the ICP-PERP financial instrument on the FTX exchange was used to manipulate the market, and asks that Sam Bankman-Fried deny his involvement.

The Arkham ICP Report would have received very little attention, but, apparently thanks to Andrew Ross Sorkin, it was published in concert with two articles in The New York Times, which presented the report as respectable. By legitimizing the report, The New York Times caused tremendous damage to the reputation of the project, the Dfinity Foundation and its leaders, and harmed its ecosystem. Arguably, this led the ICP market cap to devalue by tens of billions dollars more. It is unknown why The New York Times chose to promote the Arkham ICP Report, given its origin and content, which clearly made it unworthy as a legitimate source of information.

By all accounts, the Dfinity Foundation did not sell any of its ICP tokens for weeks after genesis, and the project's founder has said he sold only a tiny fraction of his tokens (see here, here and here). Furthermore, simple common sense dictates that if the market price for ICP was too high after network genesis, then obviously it would have fallen naturally through normal price discovery in all circumstances, without any need for "insiders dumping".

In this report, we examine who and what was behind the Arkham Intelligence report, and the perplexing decision of The New York Times to promote it. As we show, the deeper Arkham Intelligence is investigated — which this case pursues with spy video and other means — the more perplexing the decision looks.

The New York Times

The New York Times published the article "The Dramatic Crash of a Buzzy Cryptocurrency Raises Eyebrows." Meanwhile their Dealbook newsletter placed on their website "How ICP's Vaunted I.C.O. Crashed," which they also pushed to its subscribers (UPDATE: after publication of this case, DFINITY filed a defamation suit against The New York Times and Arkham Intelligence, and the NYT edited the title to remove the term "I.C.O."). The article legitimizes Arkham Intelligance as a "crypto analysis firm," and promotes the Arkham ICP Report, providing a direct link to its PDF file. Meanwhile, while Arkham had not published anything before, and more than a year later, it has not published anything else.

Ironically, because there was a mysterious lack of information about Arkham Intelligence and Miguel Morel available, it seemed all the more certain that the NYT had performed some basic vetting of their backgrounds and the substance of their report. However, it seems that basic fact checking was not performed.

The NYT incorrectly repeatedly refers to the Internet Computer undergoing network genesis as an "initial coin offering" i.e. an "ICO" — something that regulators have long banned — apparently to deliberately tarnish those involved with the project as being engaged in illegal activity (an ICO involves an organization selling unusable tokens to the public to raise money for research and development, with the promise that this will make the tokens usable).

The fundamental thrust of the narrative promoted by the NYT can be boiled down to the words of Miguel Morel, in a short video he published on Twitter to promote Arkham's ICP Report. Miguel Morel narrates the video to a background soundtrack of the kind used by TV crime-exposés, which makes the purpose of his message and claims clear.

Miguel says of the falling ICP price: "it appears that this was not a coincidence or accident, but was a case of misconduct by those who seem closely connected to ICP and who have been dumping billions of dollars of ICP while smaller supporters and retail have been left in the dark watching their investments tank ... we will provide ICP holders with the clarity that they deserve ... My team at Arkham Intelligence conducted a comprehensive analysis of the ICP blockchain, and what we found causes us to believe that insiders have continuously deposited billions of dollars of ICP on exchanges as everyone else watched their investments tank. If the available data in our analysis is accurate, we should be asking questions about what could be one of the most extreme cases of investor mistreatment in the history of crypto markets and financial markets overall."

Miguel makes unequivocal statements about the guilt of the Dfinity Foundation and related persons. Even though Arkham Intelligence only had a mere 200 followers on Twitter at the time of publication, thanks to the NYT's promotion using their article and DealBook newsletter, Arkham's video had been seen almost 20,000 times by May 2022, and their narrative became known worldwide.

As our Case #1 showed, very likely the Arkham ICP Report was created for the specific purposes of causing such damage, either by a competitor, or by market manipulators looking to short ICP. So why would The New York Times, which has a distinguished history and mission to seek the truth on behalf of its readers, and its star reporter, Andrew Ross Sorkin, lend their credibility and well-earned reputation to Arkham Intelligence, even though there were abundant indications that ulterior business motives were involved?

From the moment our investigators began to collect spy video, to understand happenings, it became clear something was off...

Key investigation results

- Arkham Intelligence, mismatching dates and their secret, opulent new HQ

- The Arkham team, and their roles at the Reserve cryptocurrency

- Miguel Morel's strange background, and links to a cult

- Arkham's anti-Semitic lieutenant

- Was Arkham paid?

- Evidence the report was commissioned

- The facts didn't really matter to Arkham

- The Arkham investor is Tim Draper

- Suspicious activity in Chelsea

- The many ways harm was caused

- NYT must remedy the situation

Arkham Intelligence

It appears likely that Arkham Intelligence is named in homage to Gotham Research, a well-known and well-respected investigative financial research firm. We do not believe, however, that the NYT confused the two when deciding to promote Arkham as a credible "crypto analysis firm". Arkham Intelligence had no track record, and publicised only a single employee, Miguel Morel, who also lacked any track record. These points alone raise serious red flags, but they only needed have scratched the surface to see there were far more serious issues.

Where exactly is the Arkham Intelligence team?

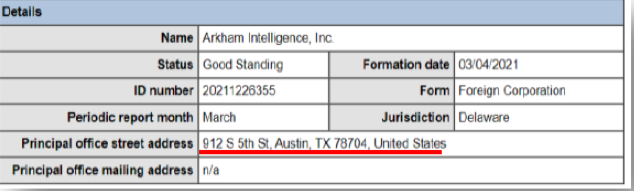

Their Delaware registration, reveals it was formed 4th March 2021.

However, this formation date does not match up with their Twitter profile, which claims to have been created in May 2019, almost two years earlier, suggesting it is a sham profile that has been purchased and renamed for purpose. Their first tweet only appeared on the 28th of June, 2021, the very same day that the New York Times published the article. This date also doesn't match with Miguel Morel's LinkedIn profile, which says he joined Arkham in January 2020. But these inconsistencies with dates are just the beginning.

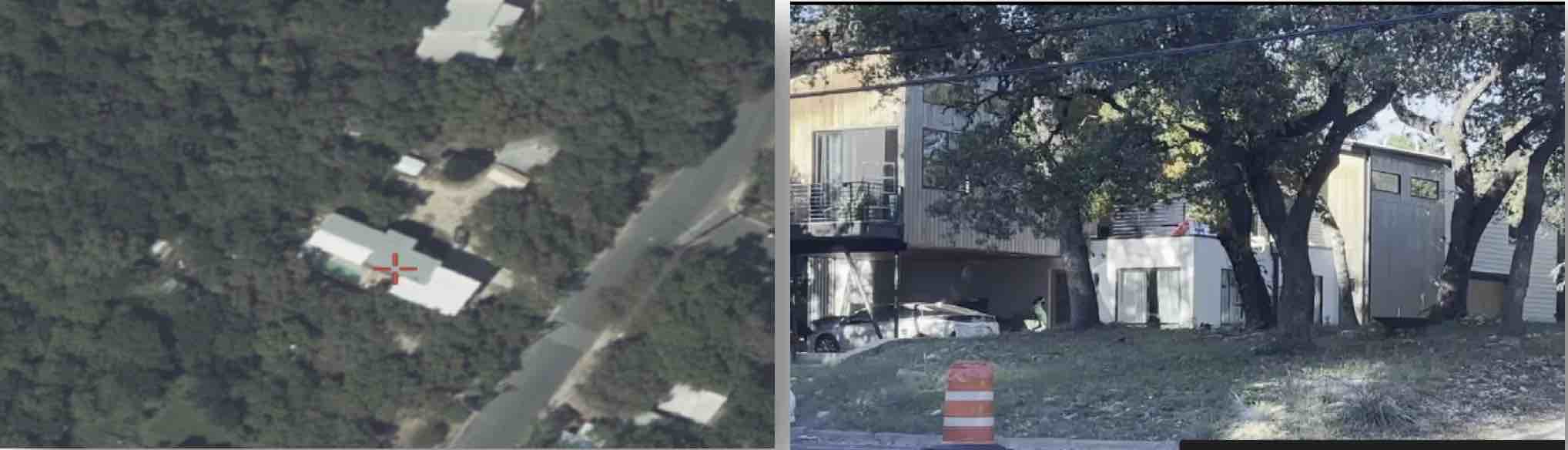

For some time after publishing the report, what existed of Arkham's team, were however based at the corporate address listed in the Delware registration. This is based in the countryside outside Austin, Texas, rather than the kind of offices where you would expect to find a respectable research firm:

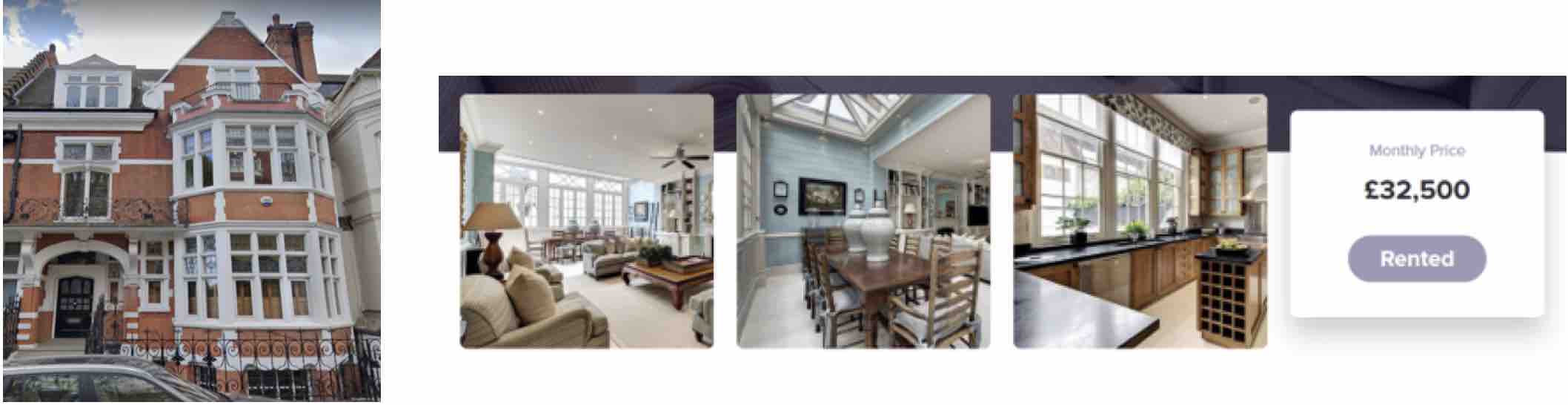

But the small team of individuals (or at least, afflilated individuals) moved out of Texas after publishing the Arkham ICP Report. Perhaps they came into significant money, because they moved to a luxurious and fashionable house in the Chelsea district of London, England. Their rent there is 32,500 GBP, or $43,000 USD a month, according to the original advertisement.

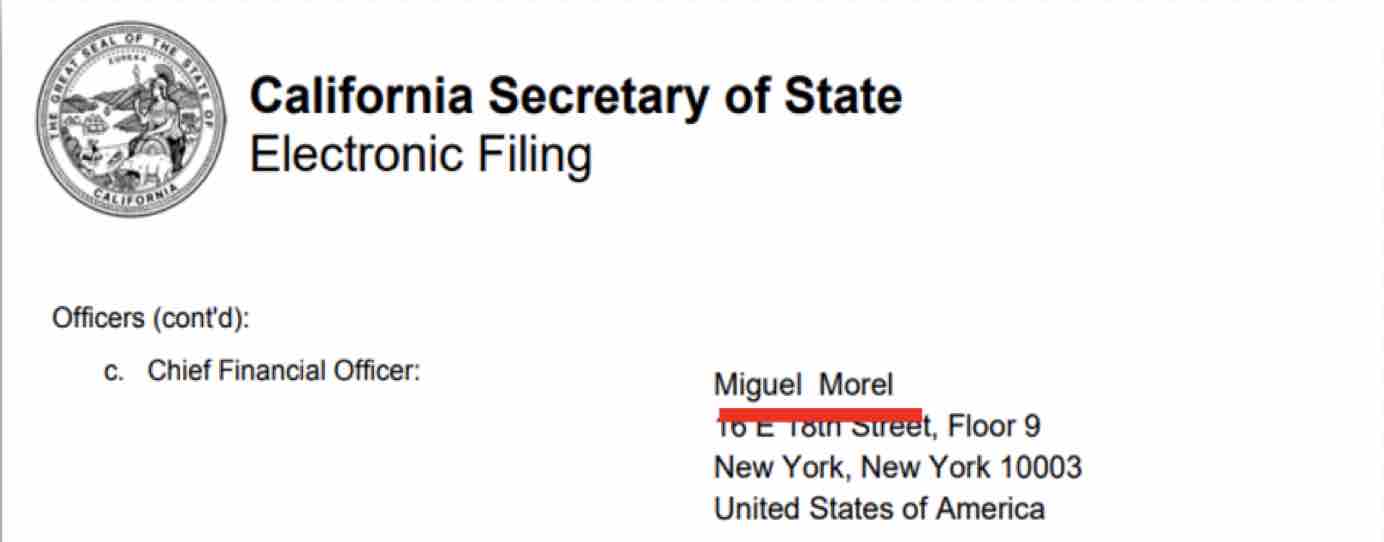

One might assume that performing "crypto analysis" might be a simple business, but they are registered all over the United States: Delaware, California, New York and even Colorado.

The Arkham team in Chelsea

Arkham's new headquarters in Chelsea, London, houses a number of Arkham's team members or affiliates. Miguel Morel is joined by: Henry Fisher, the former Chief of Staff at Reserve cryptocurrency, and current CTO at Arkham, Charlie Smith, former Head of Business Development at Reserve cryptocurrency, a co-founder of Arkham, and founder of another start-up, Jonah Bennet, journalist and co-founder of an online magazine that employed several Arkham employees as writers, Zachary Lerangis, current Head of Operations at Arkham, and Keegan McNamara, former TPM at Arkham and founder of another start-up.

Three things are noteworthy. Firstly, those at this location are all in their early 20s. Secondly, Charlie Smith and Keegan McNamara are now former members of Arkham, since they are working on new startups, reflecting the fluid nature of Arkham's composition, and why it should not be thought of as a traditional company. Thirdly, three individuals at the house have links to a cryptocurrency "stablecoin" project called Reserve, which Miguel says he co-founded...

The Reserve cryptocurrency

Reserve is not a large technology project like the Internet Computer. It aims to provide a "stablecoin" that is maintained by smart contracts running on the Ethereum blockchain. Investors buy into the project via its RSR token, whose value has fallen by more than 96.5% since its peak. One would expect a thoroughly researched, impartial and objective report would be written by professional researchers, rather than cryptocurrency entrepreneurs, which might lead to highly partisan and inaccurate conclusions being reached. What's particularly perplexing, is that their own token was falling dramatically at exactly the same time as the ICP token, but they presumably do not claim that its price fell because of insider selling.

Across the industry, many tokens went into steep price falls due to the bitcoin price crashing, which began almost the moment the Internet Computer underwent genesis. BTC fell from $63,314 to $29,807 USD between April 14, 2021 and July 20, 2021. Its steepest fall began on May 10, 2021, the very day that the Internet Computer genesis event occurred, afterwhich it fell more than 40% in the following two weeks. Their report completely failed to account for the effect this would have had on the price of ICP, even though it dragged their own RSR token down 79.4%.

Even though they had direct experience of how crypto market volatility was impacting token prices at the time, when Arkham produced the ICP Report, they mysteriously made no mention of these general market moves, and chose instead to weave a false narrative of malpractice, proving that their actions were intentional and wilful.

Miguel Morel, CEO and founder

At the time the ICP report was published, founder and CEO, Miguel Morel was the only employee publicly associated with Arkham. His LinkedIn profile from the time revealed minimal information about this career and credentials. He appears to have graduated high school while taking some courses offered by colleges at the same time, given that their logos have been added to his resume. Miguel claims to have been a co-founder of Reserve, a relatively small cryptocurrency project, but shortly after the Arkham report was published, the Reserve project removed any trace of him from their websites (however this web page from March 2020 appears to show his claim to be a co-founder is correct).

Although Reserve did not list Miguel as a co-founder at the time Arkham published the ICP Report, their website did contain a single blog post attributed to Miguel Morel, which was quickly removed. The blog post was interesting, because it appeared to show that Miguel Morel might be prone to believing in conspiracy theories. It contained the paranoid-sounding text: “Venezuela is in a downward spiral. The Americans are involved. The Cubans are involved. The Russians are involved. Other countries you've probably never heard of are involved. The epistemic environment is poisoned by divergent geopolitical interests. Affairs in Venezuela are thus opaque.”

According to information on the internet, it appears that Miguel Morel was at high school 2013-2017, and that immediately afterwards, from June 2017 to January 2019, he was an "Entrepreneur in Residence" at a place called "Paradigm Academy". Paradigm Academy is a coaching and training center. According to our research, the majority of their employees and students were graduates of another place, called Leverage Research. Leverage Research sought to be a "Non-profit psychology and human behavior research program that aims to improve the world by understanding group psychology to lead people to live in harmony together". But what does that mean?

This is the main building of Leverage Research, in Oakland, California.

Leverage Research has been reported to be a cult, where its members go through

harmful "charting" and "debugging" processes.

One former employee, Zoe Curzi,

gave details and described how many members who left experienced psychological distress and PTSD, as well as

the devastating impact it had on her life.

| “ | This whole experience was really fucking confusing. The gaslighting and lack of public knowledge has exacerbated the struggle for a coherent description of events and dynamics, and I spent a long time believing I was at fault for the pain I was going through. I've never been so confused or overwhelmed by anything in my life. |

Another former employee, Cathleen, described her experience as

"somewhere between painful and horrifying".

| “ | ...my lived experience was often somewhere between painful and horrifying. I'll offer some possible explanations for why the environment was so bad for me, but whatever the cause, the result was that I was largely crippled by the time the project wound down. Two and a half years after leaving, I'd say I've done a lot of healing and I've also been able to adapt my life to accommodate the various ways in which I still struggle. |

Miguel Morel is thus a young man, only 21 years old, who previously chose to work as an "Entrepreneur in Residence" in a place with strong connections to an alleged cult, with no obvious educational or business experience that would qualify him to produce credible research of the nature published. Moreover, while it is unclear what Miguel Morel means when he claims to be a "co-founder" of the Reserve cryptocurrency project, this affiliation reflects that he may have pre-existing financial interests in crypto that may make his claims far from impartial and objective.

Clearly, this is not the normal kind of person the NYT would trust when promoting and legitimizing claims that could cause billions of dollars in damages.

Arkham's anti-Semitic lieutenant

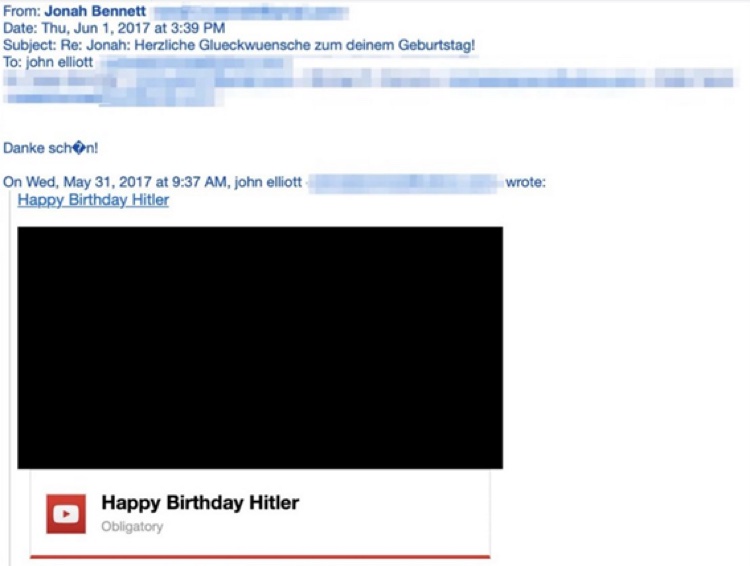

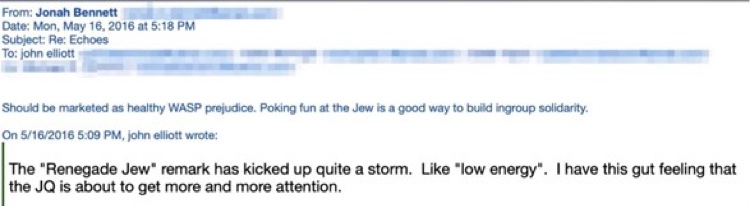

Within the darkest recesses of the blockchain industry, there are individuals attracted to blockchain because they are anti-Semites, and they want to destroy the banking industry because they equate it with Jewish people. In the course of this investigation, one of Arkham Intelligence's key team members or affiliates, Jonah Bennett, now resident in their luxury Chelsea abode, and the person whose home address is the registered place of business for Arkham, was once apparently caught making anti-Jewish remarks online, as well as celebrating Hitler's birthday. His email is below:

In the following, "The JQ" is an abbreviation for "The Jewish Question", an expression first used by Nazis, often in conjunction with "Final Solution", which was what they called their system of concentration camps that murdered millions of Jewish people.

It is not known whether the NYT was aware Arkham involved people with links to an alleged cult and anti-semitic beliefs at the time they legitimized their content.

Was Arkham paid?

The NYT published their article and DealBook newsletter promoting the Arkham ICP Report on 28th of June 2021. A few days later, as damage against the Internet Computer ecosystem and ICP token was being wrought, Miguel Morel made his last ever tweet (at the time of writing), claiming he was not hired to produce the report, nor received any form of compensation, and that he did not have a position in ICP tokens:

These questions still remain unanswered. I was not hired or compensated to release this report, nor did I or any of the entities I own have any position in $ICP.

— Miguel Morel (@RealMiguelMorel) July 3, 2021

Investors deserve to know what’s going on.

Read the full report here: https://t.co/8g3Ja9BCXu https://t.co/Ct3IOHryvG

However, in the clip below Nick Longo states that he believes a client had paid for the production of the report:

Johan Bennett was more forthright about why Arkham produced the report:

Apparently, Arkham is developing a blockchain transaction analysis product, which is derived from other pre-existing technologies. When talking about the tool, and its potential for misuse, Nick Longo appears to acknowledge that the client was a "business rival":

The evidence indicates that the report was professionally produced to order, with the purpose of laying the blame for the falling ICP price on the Dfinity Foundation and project "insiders" involved with bringing the Internet Computer ecosystem to life. It appears that the report essentially seized on a number of large ICP transactions, then held them up without other evidence or context to claim they showed "insiders" selling. The report never once questions why the ICP price was so high after genesis, nor addresses why the price would not fall naturally if it were too high (despite repeatedly drawing attention to the enormous size of the initial network market capitalization, and claiming that it was over 300 hundred billion dollars). Despite their "comprehensive analysis," they also fail to ask whether the high initial price might have resulted from manipulation by attackers wishing to harm the Internet Computer ecosystem, who knew this would cause it to crash thereafter.

Not only does it appear the report may have been created for a paying client — who theoretically might even have been involved in manipulating the ICP price to cause it to crash — but also that its strongly made claims were knowingly made without reasonable foundation:

The Arkham investor is Tim Draper

Tim Draper is an American billionaire, who holds a vast portfolio of investments in a range of cryptocurrencies. His investments began with significant holdings in Bitcoin and have since grown to span the spectrum of emerging players such as Ripple, Bitcoin Cash, Tezos and Aragon. His legacy is continued by his son, Adam Draper, who through his VC fund, Boost VC, holds large investments in Bitcoin, Monero, and Ethereum, and possibly others.

Did the Drapers consider the Internet Computer blockchain, and its primary developer, the Dfinity Foundation, a direct threat to their family holdings, because the technology challenges its proximate competitors across all common blockchain metrics, while introducing completely new capabilities? Only time will tell whether such a hidden party was involving in directing or sponsoring Arkham in its attack.

Miguel Morel publicly asserts that the Arkham ICP Report was unsolicited and was produced for the sake of the blockchain community. However, not only does it seem possible that it was commissioned by parties unknown for unknonwn reasons, but as Nick Longo reveals below, it was produced using Tim Draper's funding:

Suspicious activity in Chelsea

The Arkham Intelligence team moved to a luxury Chelsea mansion after publishing the Arkham ICP Report. At this mansion, we recorded interesting and inexplicable goings-on. Stuffed holdalls began to arrive at the property by taxi, which contained unknown cargo. In the recording below, Eastern European security looks up and down the road nervously as the holdalls are conveyed inside:

Miguel Morel would sometimes personally arrive carrying holdalls, accompanied by his own burly bodyguard, and again, they both looked around nervously until they were off the street.

The many ways harm was caused

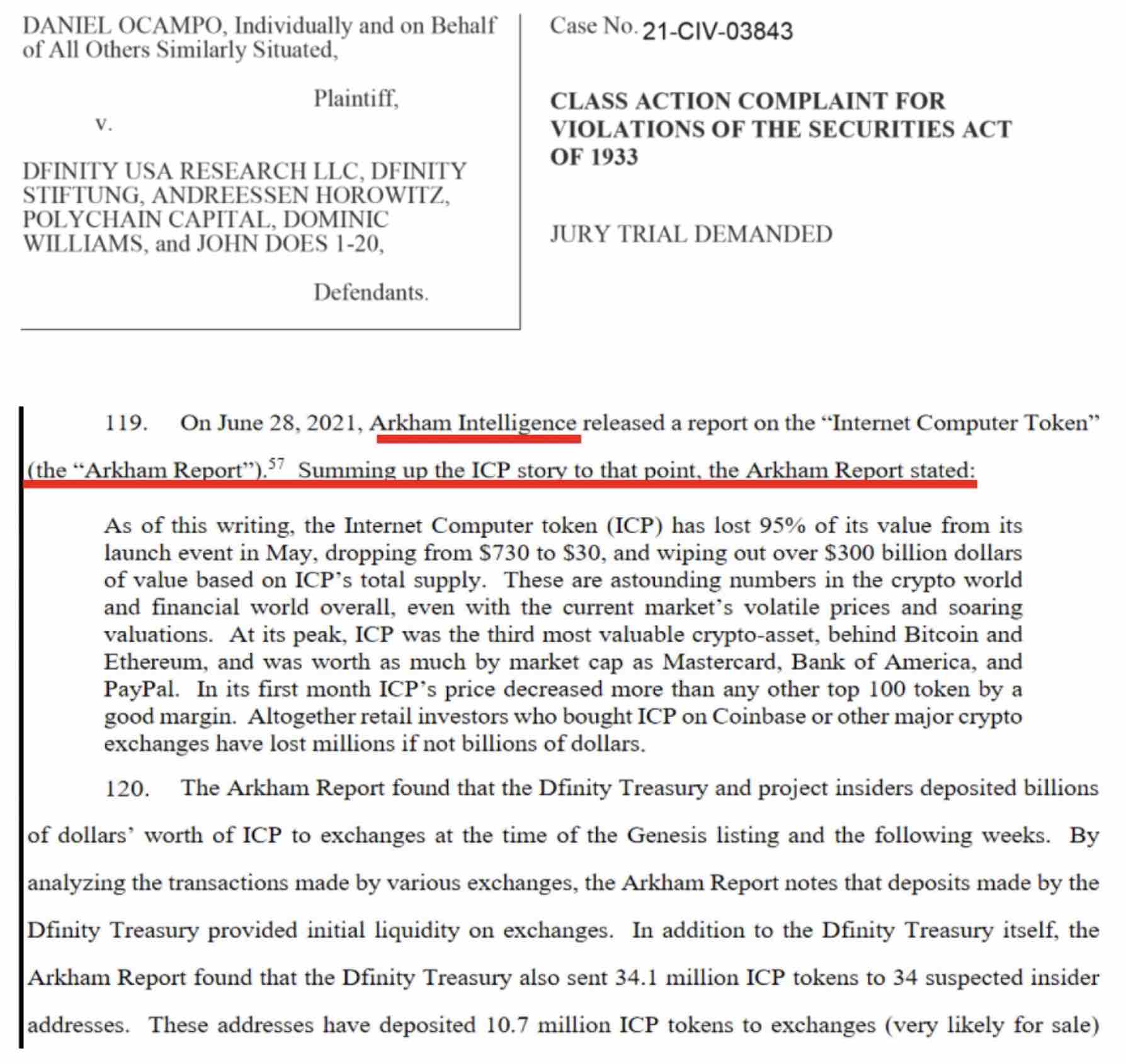

We have uncovered multiple cases where parties believed Arkham's claims, simply because they felt The New York Times endorsed them, and then directly took actions that harmed the Internet Computer ecosystem, compounding the reputational damage. This extends to class action lawsuits by ambulance-chasing lawyers, one of which is shown below, revealing the multitude of ways harm has been caused:

NYT must remedy the situation

As this case investigation has shown, The New York Time greatly misled the world by presenting Arkham Intelligence as a respectable "crypto analysis firm". Not only do Arkham appear to lack the skills necessary to create a serious report, but almost every aspect of the organization is highly dubious. While our case investigation brings hard evidence such as video recordings that are hard to obtain, even a most basic and cursory investigation of Arkham would have shown The Times that they should not to be trusted under any circumstances — from the strange misaligned dates on their profiles, to the complete lack of any previous history recorded about them or their founder on the internet.

Elevating Arkham and its report in this manner will likely have reduced the valuation of ICP by several billion dollars, and amplified an already vile campaign against a major blockchain project. As we have shown, Arkham was paid to produce the report, possibly by a competitor, or someone with short positions in ICP, and their main investor also invests widely in blockchains that the Internet Computer might be seen as competing with. While the false narrative may have pleased the client, and possibly their main investor, the result clearly damaged the reputation of the Internet Computer ecosystem, and harmed ICP holders. Lawyers must confirm whether this is professional defamation. But what is beyond doubt, is that the Arkham Intelligence report, and its further publication via The New York Times, caused vast harm to many parties.

The NYT should now take the following steps to reduce the ongoing harm that their support for the Arkham report is causing:

Firstly, the NYT should explain to its readers why it presented Arkham Intelligence as a viable "crypto analysis firm" worthy of coverage.

Secondly, they should responsibly publish a retraction and correct the false information shared in their original article.

Lastly, the NYT has unwittingly been drawn into a conspiracy to defame and manipulate markets that has harmed thousands of people, and they should now reveal who presented the report to them, such that it can be investigated whether this was the arch-conspirator that commissioned the report from Akham in the first place.

Read more case investigations...

We show the public what goes on behind the scenes in crypto. If you can help, please become a whistleblower.