We collect and publish covertly filmed video footage in accordance with all applicable laws.

Key findings

- Ava Labs is the creator and promoter of the Avalanche blockchain, and secretly granted company stock, and tranches of their AVAX tokens worth hundreds of millions of dollars in 2021, to six key partners at the law firm Roche Freedman.

- Using spy video we record conversations Kyle Roche, founder of Roche Freedman, in which he makes extraordinary statements regarding a secret pact they have with Ava Labs.

- Kyle Roche says the pact gives them a secret purpose, which includes weaponizing the American legal system to attack swathes of the crypto industry.

- Kyle says they harvest confidential industry information from targets using legal discovery processes, which information is shared with Ava Labs.

- Kyle says that they widely sue crypto industry participants to create decoys that draw the SEC and CFTC away from Ava Labs and their activities.

- Kyle says that they create securities class actions against blockchain projects that threaten to disrupt Avalanche, such as those developing the Internet Computer, and Solana.

- On video Kyle predicts how they will create a securities class action against Solana for Ava Labs, which class action they created five months after the video was recorded.

- Kyle has a close relationship with Emin Gün Sirer, founder of Ava Labs, and co-founder Kevin Sekniq, describing them as being like "brothers."

- Emin has a track record of using deception and underhand tactics to attack enemies and rivals, for example surreptitiously acquiring control over another project's reddit to undermine their social media.

- Kyle displays a contempt for the American legal system.

Ava Labs, Avalanche and Roche Freedman

Ava Labs is an American for-profit company that develops and promotes the Avalanche blockchain, which recently raised substantial funding in collaboration with Three Arrows Capital, the failed hedge fund that has been accused of acting like a Ponzi scheme. It is led by CEO and founder, Emin Gün Sirer, and claims to employ more than 150 people. The Avalanche network currently has a fully diluted market capitalization of more than $16.5 billion USD.

Roche Freedman is a law firm that widely sues people in crypto, currently running at least 25 class actions, including against Binance, the crypto exchange, and Ava Labs (Avalanche) competitors Solana Labs (Solana) and the Dfinity Foundation (an Internet Computer contributor). It is led by founding partner, Kyle Roche, and employs more than 30 lawyers.

We can reveal that for several years they have been operating according to an extraordinary secret pact that harms the crypto industry, and has a nature so perverse that it undermines the integrity of the American legal system.

Some years ago, blockchain company Ava Labs and Amercian law firm Roche Freedman, made a deal. A pact was formed that involved Ava Labs granting Roche Freedman a massive quantity of Ava Labs stock and Avalanche cryptocurrency (AVAX), now worth hundreds of millions of dollars, in exchange for Roche Freedman agreeing to pursue a hidden purpose.

In a shocking series of video recordings, shared by this case investigation, Kyle Roche himself now reveals the exact nature of their ongoing operations. The case is highly disturbing in nature.

We can reveal that the pact directs Roche Freedman and their leader Kyle Roche, to: 1) use the American legal system - gangster style - to attack and harm crypto organizations and projects that might compete with Ava Labs or Avalanche in some way, 2) sue crypto industry actors generally with the aim of creating magnets for regulators such as the SEC and CFTC that distract them from the highly commercial nature of Ava Labs and the Avalanche blockchain, and 3) secretly pursue Emin Gün Sirer's personal vendettas against individuals.

As usual, Crypto Leaks brings you the hard evidence that nobody else can obtain. We explain with the help of words spoken by Emin Gün Sirer's own lawyer, Kyle Roche.

Ava Labs & Roche Freedman co-locate

August 2019, the newly formed law firm Roche Freedman moved into a co-working space with Ava Labs, the for-profit company that develops and promotes the Avalanche blockchain.

Big money establishes a secret pact

In exchange for Roche Freedman providing what Kyle calls "legal services", Ava Labs granted them massive amounts of:

- AVAX

the Avalanche blockchain's tokens.

the Avalanche blockchain's tokens. - Ava Labs corp's stock (Ava Labs holds AVAX for founders and investors).

Kyle Roche says he was the very first person to receive Ava Labs stock after Andreessen Horowitz, a venture capitalist that provided their initial funding.

So if Ava Labs was flush with cash having just received investment from Andreessen Horowitz, why did they need to pay for "legal services" in this way?

The answer is that they were not paying for normal legal services. The massive payments of AVAX and Ava Labs stock established a secret pact. This was so unusual, that it required the grant of assets that are worth hundreds of millions of dollars today.

Kyle boasts he has a full point on AVAX, and Ava Lab stock...

Kyle says he has about a third of what Kevin Sekniqi has, who is the co-founder and current COO (Chief Operating Officer) of Ava Labs.

Kyle says that he helps control the AVAX token supply, and helps Ava Labs with "regulation issues," and "competitors..."

Kyle refers to Emin Gün Sirer by his nickname, "Goon."

He says he trusts "Goon" and Kevin "like brothers," and that they have the "same interests..."

As the conversation progresses, the truth about the pact begins to emerge: Kyle confirms that they litigate against (sue) other parties in crypto as a "strategic instrument" to "support Ava Labs" to a level where they made him an "equity partner." Kyle says litigation "is an underused tool."

Kyle describes participating in the pact as a:

| “ | completely different way than being a lawyer |

Kyle Roche moved to Miami for "tax purposes."

He moved in with Kevin Sekniqi, Ava Labs' COO, reflecting just how tightly the organizations work together.

In the years since he moved, Kyle Roche has failed to update his LinkedIn profile, which still lists his location as the "New York City Metropolitan Area," which is a more prestigious place to locate a law firm.

Naturally, Kyle's profile makes no mention of Avalanche or Ava Labs.

Behind this elaborate smokescreen, Kyle is working from Miami with two key objectives: 1) to increase the price at which he can sell his AVAX tokens and Ava Labs stock, and 2) to reduce the amount of tax he pays when he sells.

Harvesting confidential information

As the conversation continues, the first signs of the perverse nature of the secret Ava Labs/Roche Freedman pact begin to emerge.

Kyle reveals that he started out as a "crypto expert" for Ava Labs. But how, you might ask, could a lawyer be a "crypto expert" for a company that develops and promotes a blockchain.

Kyle reveals that answer.

He can contribute a special kind of expertise and knowledge — which he explains he has been

able to obtain because:

| “ | I sue half the companies in this space |

In the USA, when you sue an individual or company, you can demand access to their confidential accounts,

commercial data, email and social media communications, and more, using a special legal process known as

"discovery".

This has resulted in him:

| “ | seeing the insides of every single crypto company |

Kyle boasts that being able collect information in this way has resulted in him

becoming one of the:

| “ | top 10 people [experts] in the world [in crypto] |

If a blockchain company could unfairly gain access to the confidential information of others, they could use it as a powerful competitive tool. It seems that Kyle sharing this special expertise with Ava Labs was one of the key factors that convinced Emin Gün Sirer to make the pact.

Until proven otherwise, we must assume that Ava Labs may even have directed Roche Freedman as to what confidential information they should harvest from the industry. It is unclear how much confidential information Ava Labs has obtained, but the potential for extreme wrongdoing is very concerning.

Naturally, you can be sure that during discovery against a target, Roche Freedman automatically demands the identities of investors, contractual agreements with partners, customer lists, payroll details, and information about every other kind of financial transacton, related to the organizations they are litigating against, and their founders and executives. They will also ask for complete email, Slack and other communication histories, which provide them with a treasure trove of information valuable to a competitor, including even technical insights.

The many crypto industry participants who have been litigated against by Kyle Roche must now question exactly how much of their confidential data is now in the possession of Ava Labs executives.

Harming competitors and fooling regulators

Roche Freedman runs litigation against numerous people and organizations in the blockchain industry (i.e. it sues them). A favored method is to initiate class actions. Several months ago, Kyle Roche claimed to be running more than 25 class actions.

Roche Freedman class actions: In their American class actions, they propose a class of people whom they claim have been harmed, for example because they lost money trading a cryptocurrency. They then create a lawsuit in their name, for example claiming that the cryptocurrency is an illegal security, and that therefore that those developing or promoting the blockchain involved, or those running crypto exchanges that enabled them to trade the cryptocurrency, are liable for the losses of everyone in the class. In the United States, they only have to find one person willing to be a representative plaintiff for the class to initiate action.

When they create class actions and other litigation against Ava Labs competitors and crypto industry participants, Kyle Roche has revealed that Roche Freedman often has two hidden purposes:

- Surreptiously causing harm to a competitor.

If there are two horses competing in a race, and you can hack at the leg of one, the other will win. Their horse is AVAX and Ava Labs stock. Initiating a class action against their competitors can harm them in multiple ways, and so they have secretly weaponized the legal system to do this. Even when they can make only a weak case, such that with high probability they will lose the litigation, this can still harm their targets, greatly profiting them. Moving the price of AVAX by only a small amount, by harming competitors, can produce big gains for them when they make sales from their huge hoard of AVAX tokens and Ava Labs stock. Ava Labs is not ever named as the litigant — the class of plaintiffs is — disguising what is really going on.

- Luring regulators, including the SEC and CFTC, away from Ava Labs.

They often litigate against competitors in ways that make them look guilty of regulatory transgressions. Directing the attention of regulators towards competitors can cause further great harm to them, but also serves to lure regulators away from Ava Labs and their ravenously commercial behavior, which regulators would otherwise be very interested in. Kyle tells us he litigates to create "other magnets" for regulators to go after. They also do this to crypto actors who are not obvious competitors.

Here's a quick crib sheet for what is going on:

- Roche Freedman typically attacks competitors using American "class actions," in which they claim to be representing a group of people who they claim have been "harmed" (the plaintiffs). For example, they can claim another blockchain's tokens are illegal securities, and consequently some people who traded them suffered unfair losses when the price fell.

- In the United States, class action legal filings are "protected speech." This allows Roche Freedman to make damaging claims about other projects that are in reality completely false, without risk of being sued for defamation (or "libel"). For example, they filed a lawsuit against the Dfinity Foundation that essentially parroted the false claims of Arkham Intelligence. The purpose is to damage the reputation of their targets, and/or surround their brands in FUD.

- Once Roche Freedman has initiated litigation against a target in crypto, they can collect/harvest confidential information from them using the legal discovery process, creating "expertise" that they can share with Ava Labs.

- The nature of the American class action system forces targets to spend far more on defense than Roche Freedman spends litigating against them. This is because if they lose — and juries are unpredictable — the judge can award astronomical damages against them. This drains the resources of competitors, as well as distracting them from their core work.

- Roche Freedman's financial risk is limited to the money it spends on litigating against a target. This is because another quirk of the American legal system prevents the targets of their class actions from claiming their legal costs back from Roche Freedman if they win.

- Roche Freedman can spend a few million dollars litigating against an Ava Labs competitor, and lose the case, and still come out on top, if their actions harm or suppress a blockchain that competes with Avalanche (since if their actions may drive the price of AVAX even slightly higher, such is the size of their holdings, they can make a substantial profit).

- By naming the founders and executives of blockchain ecosystems and companies in their class actions, they can threaten them with total bankruptcy if they lose. This destablizes their key leaders and innovators, also placing tremendous pressure on their families, especially when there are children involved. Naturally, if they can cause family issues for the leaders of competitors, this will further degrade their capabilities.

- Ava Labs and Roche Freedman seek to surreptitiously increase the price of AVAX in a ruthless and highly commercial manner. Their desire to promote AVAX and increase its price at any cost greatly increases the risk that the SEC would class the AVAX token as an illegal security. To divert the attention of regulators like the SEC and CFTC elsewhere, they widely litigate against other actors in the blockchain industry accusing them of regulatory transgressions. This protects them by diverting attention elsewhere, while increasing the regulatory risk of the target, which is doubly useful to them if they are some kind of competitor.

Kyle Roche says he is the reason Ava Labs haven't been sued.

He says that to protect them, he makes sure that:

| “ | the SEC and CFTC have other magnets to go after |

Kyle even claims that thanks to his efforts, he has ensured that for Ava Labs, there's

| “ | no such thing as regulation for what they want to do |

Emin Gün Sirer's two-faced nature

Emin Gün Sirer regularly professes his support for other blockchain projects, and indicates he wishes their ecosystems the best. Here he offers support for Solana users when they were having their wallets emptied by the Slope wallet exploit, claiming kinship by saying everyone in the space was affected, and then offering apparently well-intentioned technical theories on what might be happening (all of which proved wrong).

First of all, our hearts go out to the Solana community. Attacks like this affect not just the directly targeted system, but everyone in the space indirectly by eroding people's confidence in the space. Here's hoping for a quick clarification and recovery, if possible.

— Emin Gün Sirer🔺 (@el33th4xor) August 3, 2022

Nobody should be fooled. This tweet thread was created only weeks after Roche Freedman filed a class action targeting the core of the Solana ecosystem claiming that its SOL token is an illegal security.

The false narrative Emin is establishing by these attacks hurts everyone in the industry. He should consider that one day he may find himself facing exactly the same arguments that he is establishing in his rush to hurt competitors.

Do their actions make AVAX a security?

What is most frustrating, is that Ava Labs and Roche Freedman are probably the most ruthlessly commercial operation in blockchain, which is amply revealed by their secret weaponization of the legal system against competitors. Indeed, their relentless subtle (and not so subtle) promotion of AVAX as an investment opportunity, combined with their nefarious tactics, are in fact very likely to make AVAX a security.

Kyle Roche has implored Emin Gün Sirer not to mention the price of AVAX so as not to catch the eye of the regulators. However, Emin can't contain himself when there is a major AVAX price rally.

During one such rally December 7 2021, Emin Gün Sirer even encouraged his followers by leading them in an adapted Paul Simon song:

Hello #Avalanche my old friend.

— Emin Gün Sirer🔺 (@el33th4xor) December 7, 2021

CASE UPDATE — Thanks to community

In the tweet below, Emin announced an Ava Labs marketing campaign on the

New York subway, with the strapline "It's never too late to be early."

The not-so-subtle sales pitch to investors is that it is still possible to

be an early investor in the AVAX token and make substantial profits.

Emin's tweet announced the campaign, which ran in parallel with other

Ava Labs campaigns, on December 14, 2021.

That day the AVAX price was $87.30.

By December 15, the price was $101.18.

By December 21, the price was $123.33.

At the time of writing (end August 2022) the price is around $19.

It's never too late to be early. pic.twitter.com/Hxwf3TjnkG

— Emin Gün Sirer🔺 (@el33th4xor) December 14, 2021

Roche Freedman is continually suing other blockchain projects on the basis that they have made regulatory infractions, and are therefore liable to token traders that lost money. Yet, they have never sued Ava Labs, a blockchain project that directly markets its tokens to retail investors as investment products, who have consequently lost substantial funds.

But of course, the video footage we now share of Kyle Roche makes it amply clear why they have not sued Ava Labs!

Emin Gün Sirer's personal vendettas

It is a great surprise that Ava Labs' legal proxy performs work prosecuting Emin Gün Sirer's personal vendettas. This looks like a misuse of company resources for personal purposes, which is a serious no-no in the corporate world.

His regular use of "dark power" is also most unexpected for a man who likes to brandish the title of "professor at Cornell University".

First blood: a social media pundit

Emin's first vendetta was against a Turkish social media crypto pundit who said that he "heard he was a member of FETO."

Kyle Roche found out that the social media pundit was landing in Miami for a business trip. He used the event to serve him papers, and ensnare him in the American legal system. The moment was videoed for Emin's pleasure.

Kyle shares that Emin now watches the video once a month — presumably to relive the shock and pain caused by the ambush — revealing troubling tendencies.

Kyle seems very pleased, and says:

| “ | that's why Gün loves me... |

CASE UPDATE — Thanks to community

We have not investigated the rights-and-wrongs of the Crypto Emre case.

However, the community has produced interesting additional information.

They say that early in 2021, there was a lot of excitement about CBDCs (Central Bank Digital Currencies),

and that Ava Labs ran marketing campaigns in Turkey claiming that they were in talks

about running them on Avalanche with the Turkish Central Bank, the Bank of England,

and the Bank Of Canada.

They say that Emre then debunked the claims, by contacting the central banks

involved, and then tweeting their responses (see

here,

here and

here)

and that this kind of thing was a key driver of Ava Labs' animosity towards him.

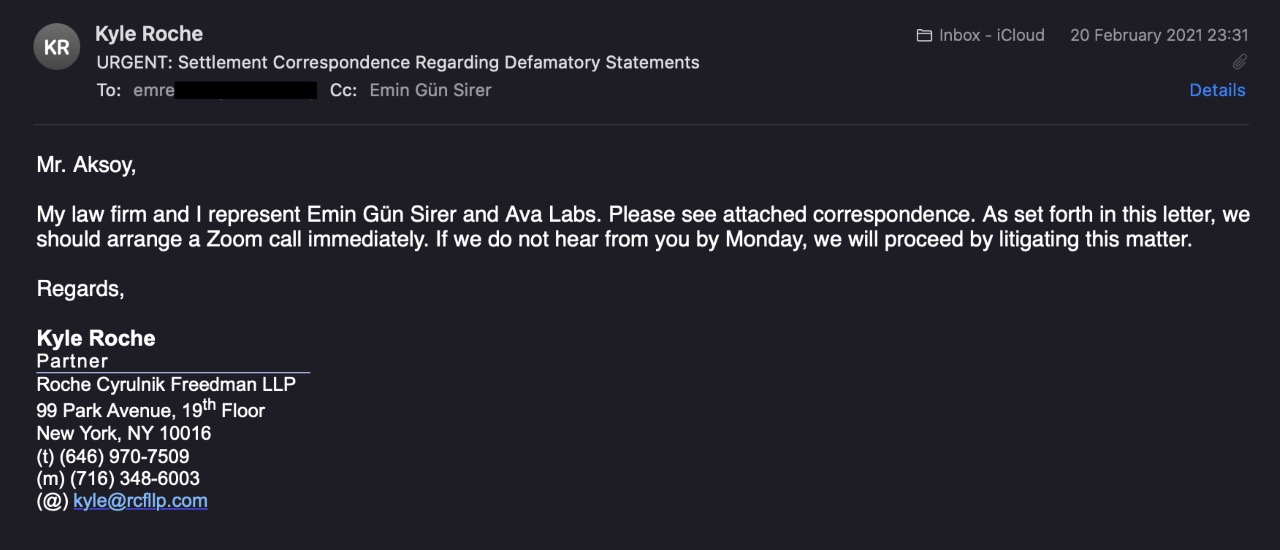

We also note that Kyle Roche/Roche Freedman threatened Emre in February 2021 on behalf of Ava Labs and Emin Gün Sirer. This contrasts with Emin Gün Sirer's recent denials of close links to Roche Freedman.

Surreptitiously attacking Craig Wright

CORRECTION — Thanks to community

Emin Gün Sirer has marketed himself as a Cornell University professor for years.

However, in fact, he appears to have ben removed from his post at the end of 2021.

Regarding his actual role: Emin completed his PhD, then spent 7 years as an assistant professor,

then transitioned to associate professor, where he remained for 14 years,

never making it to university professor.

We believe frustrations with his academic career led him to a grandiose sense

of his own academic achievements within blockchain.

There are numerous indications that Emin Gün Sirer wishes to promote himself as the "Father of Blockchain."

Recently, he had his PR people update his wikipedia page with the dramatic claim that his:

| “ | Karma system, published in 2003, is the first cryptocurrency that uses a distributed mint based on proof-of-work |

Experts in the field examining this paper say this claim is unjustifiable. Meanwhile, while developing Avalanche, he anonymously published a paper describing the consensus protocol he planned to use under the pseudonym "Team Rocket," which he then drew attention to on social media with faux rapture, as though it heralded the return of Satoshi Nakamoto:

Someone dropped this paper on IPFS and some IRC channels yesterday. It describes a new family of consensus protocols that combines the best of Nakamoto consensus with the best of classical consensus. Huge breakthrough:https://t.co/K2bATHZi8g

— Emin Gün Sirer🔺 (@el33th4xor) May 17, 2018

It was only after sustained ridicule on social media, that Emin was eventually forced to concede that it was his own team that produced the paper, thus ending his quest to emulate Satoshi through anonymous publication.

Recently, Twitter bots (i.e. fake Twitter user accounts that are directed by automated systems for the purpose of marketing), which appear controlled by Ava Labs, either directly or indirectly, have hailed Emin as the "Father of Blockchain."

Emin's grandiose sense of his own contributions to blockchain, and an envy of the Satoshi Nakamoto crown, perhaps combined with a disposition towards dark power, then led to him wanting Kyle Roche to pursue Craig Wright, who claims to be part of a small team that invented Bitcoin.

Many people fiercely disagree with Craig Wright's claim, but most people would not secretly attack him through the legal system:

Through his attacks on Craig Wright, Kyle Roche boasts how he helped massively devalue the Bitcoin Satoshi Vision (BSV) blockchain by billions of dollars. This will be of interest to Craig Wright, and every member of the BSV cryptocurrency community who sustained losses:

CASE UPDATE — Thanks to community

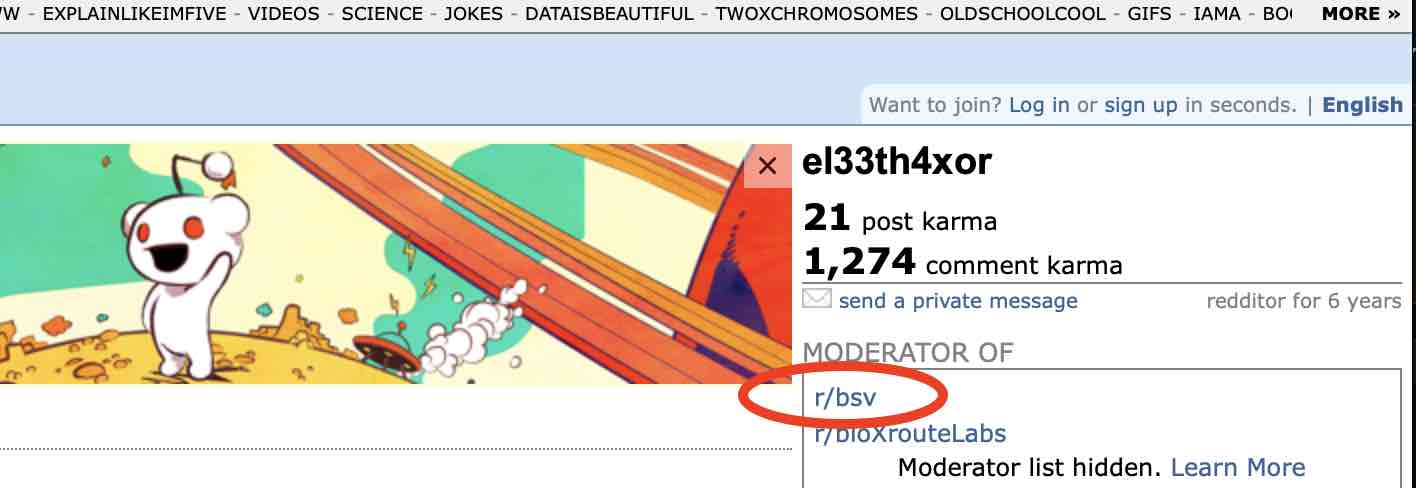

It is important to note that Emin Gün Sirer appears to have a long history of

attacking from the shadows.

The /r/BSV reddit (a kind of online public forum) was squatted by anti-BSV moderators who managed

to acquire complete control.

They then trolled BSV enthusiasts wishing to use the forum as a place to discuss the BSV network,

disrupting their community.

These moderators made great efforts to remain anonymous, but now this official link to old reddit content

appears to reveal that Emin Gün Sirer himself was one of those moderators.

Link: https://old.reddit.com/user/el33th4xor/

CASE UPDATE — Thanks to community

It appears that Emin Gün Sirer gave Kyle Roche a painting of Craig Wright as a gift

after the first phase of the Roche Freedman case against him was complete.

This speaks to the importance of his working relationship with Emin Gün Sirer and

Ava Labs.

14th February 2022 in Kyle Roche @KyleWRoche office. Kyle proudly shows me the attached picture/painting of Craig Wright @Dr_CSWright that he said was a very special gift from Emin Gün Sirer @el33th4xor for “defeating” Craig Wright in the case Kleinman vs Wright pic.twitter.com/TlL9AUKu39

— Christen Ager-Hanssen (@agerhanssen) August 30, 2022

Class actions against competitors

At another venue with Kyle Roche, it quickly became clear that his favorite class actions were against obvious Ava Labs competitors. When asked, he appeared hardly able to conceal his glee when confirming that Dfinity — the not-for-profit developer of the Internet Computer blockchain, and the subject of a major Roche Freedman class action — was a competitor to Ava Labs and Avalanche.

Kyle's personal nature emerges?

Kevin Dutton, a psychologist and writer specializing in the study of psychopathy at the University of Oxford, says that among professionals, lawyers count the second highest proportion of psychopaths, because of the opportunities the career affords them to pursue their predilections.

Psychopaths crave feelings of power and control over other people. Many display traits of grandiosity, narcissiscm, sociopathy and Machiavellianism.

We are not saying Kyle is a psychopath, as only a psychologist can classify people. However, we see these traits in his behavior, and in the following, Kyle appears to express a disturbing determination to exert power and control over others:

Filing class actions on behalf of Ava Labs

Kyle Roche has been enabled to freely pursue his predilections, because

of the vast amount of wealth provided by Ava Labs.

He says he can sue people:

| “ | just for the sport of it |

Kyle boasts how he can file class actions that attack those competing with Ava Labs (Avalanche), such as Solana Labs, and the Dfinity Foundation, on behalf of Ava Labs.

At the time we collected these recordings, Roche Freedman had already been working

on two class actions against Dfinity, and had filed one, but had not yet filed its first class

action against Solana.

However, he has now filed a major class action against Solana.

Everything he said proved true.

| “ | So, I can sue Solana! |

How Kyle Roche sees the legal system...

Kyle leverages the fact that judges and juries don't understand blockchain.

He has a colorful strategy for bamboozling juries and gaining their trust.

He calls American juries "10 idiots." He feels confident that he can work these "idiots" to control American class actions.

Earlier, when boasting about the large settlement he believed he could obtain from one of his class actions, he seems to say that a key deciding factor would be the interests of his law firm (i.e. his interests). Shouldn't the decision to settle be based soley on the interests of the class of plaintiffs he is representing?

Perhaps it's not surprising that he considers his own interests when deciding how to conduct a case, because he describes one of his plaintiff classes — people who lost money in crypto — as "100,000 idiots."

Emin and Kyle's "iLO" horror

Class action lawsuits can be very destructive. They impose vicious legal costs on those being attacked that they cannot reclaim, drain attention better used for productive purposes, and can impose terrible stress for years, including on the famililies of those targeted. Class action frameworks are not intended for use "just for the sport of it," or as a "strategic tool to competition," as Kyle Roche suggests.

They are also not intended as a means for ruthless people to squeeze money out of good people, in the mode of patent trolling, say. That kind of thing should have no place in Western democracies like America.

But to Emin Gün Sirer and Kyle Roche, litigation is just a for-profit opportunity.

They plan to create a new business on Avalanche, which will support the creation of something called an Initial Litigation Offering, or iLO. The idea is that lawyers like Kyle will be enabled to propose new class actions and other litigations en masse, and then blockchain investors will fund the proposed litigation by buying tokens to share in proceeds obtained through out-of-court settlements and damages awards.

In this sociopathic business vision, litigation is just another financial asset, and they want to provide a framework that makes it easy to mint as much as possible. Kyle appears to spare no thought for the social impact of his plans.

For Kyle Roche:

| “ | litigation is the most uncorrelated asset that exists, period |

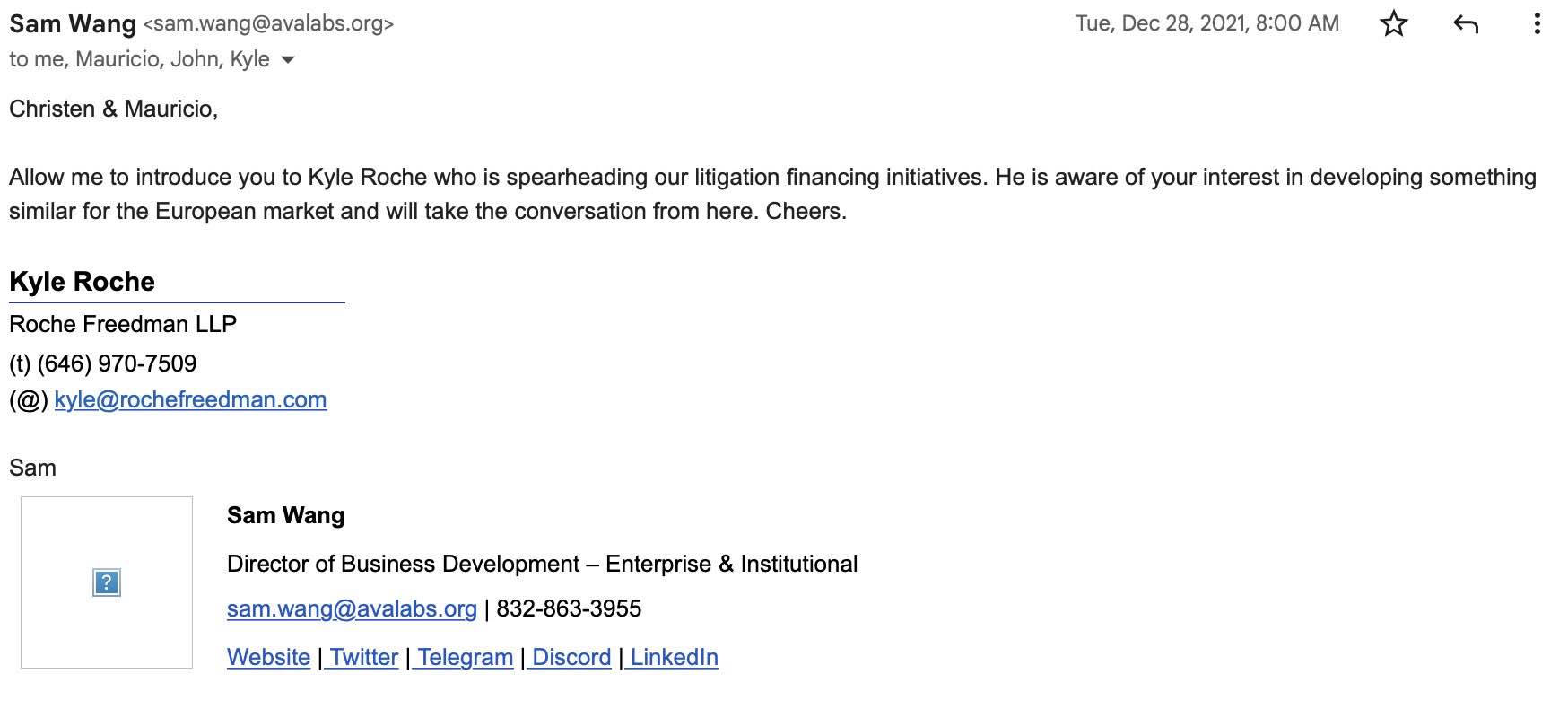

CASE UPDATE — Evidence share

Newly obtained correspondence from Sam Wang, Ava Labs' Director of Business Development, shows that as

recently as last December, Ava Labs was introducing Kyle Roche as:

| “ | spearheading our litigation financing initiatives |

This reflects how this effort is a joint venture between Ava Labs and Roche Freedman, and how they work as an integrated team. This evidence also strongly contrasts with Emin Gün Sirer's recent denials of close links to Roche Freedman:

Roche Freedman at war over its AVAX

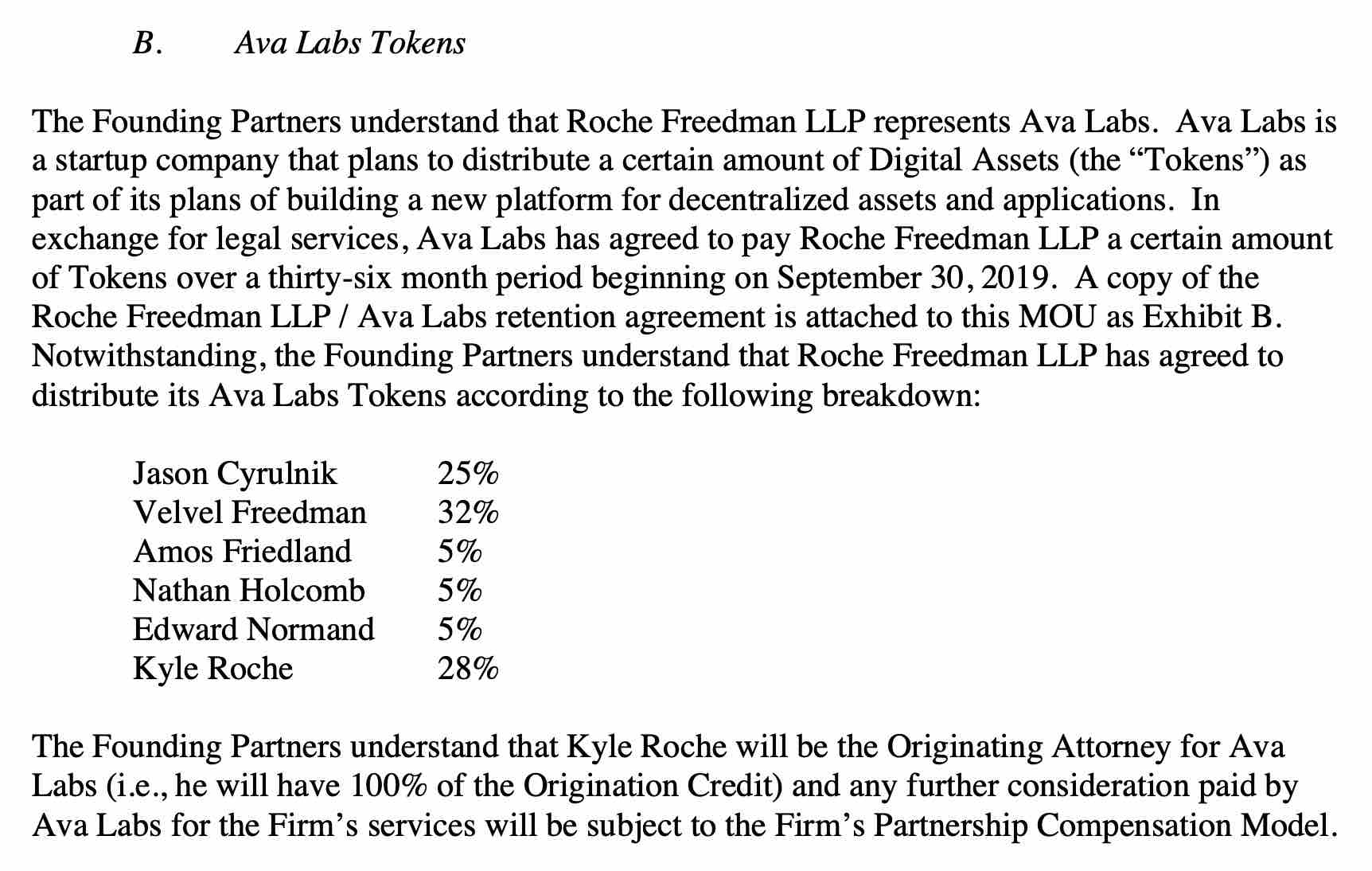

Roche Freedman actually began as "Roche Cyrulnik Freedman". But according to ex-partner Jason Cyrulnik, once it became apparent just how valuable their haul of AVAX tokens and Ava Labs stock was, Kyle Roche and Devin Freedman conspired to expel the older man from the partnership in February 2021 by out-voting him, then keeping his almost 25% share for themselves.

Now former partner Paul Fattaruso says he was hired on promise of 2% of the firm's equity, but was not told of a secret agreement between five of the partners (Kyle Roche, Devin Freedman, Amos Friedland, Nathan Holcomb and Edward Normand) to share the AVAX tokens and Ava Labs stock exclusively between themselves. These claims are now subject to numerous ongoing lawsuits.

The moral of the story is: be careful in your choice of colleagues.

CASE UPDATE — Evidence share

It was internal warfare within Roche Freedman that provided us with early hard

evidence regarding the nefarious goings-on.

In particular, we share a lawsuit filed by Jason Cyrulnik against his old partners,

https://cryptoleaks.info/cyrulnik-vs-rochefreedman.pdf.

This contained an early internal Roche Freedman MOU, which detailed how the

AVAX tokens they received would be divided.

A payment of between 4-5M AVAX tokens was made monthly over three years, terminating September 2022.

Remedies and conclusion

For anyone who cares about crypto and the blockchain industry, Crypto Leaks Case #3 should be a watershed moment. The movement was created by visionaries, theoreticians, engineers and true believers. People with integrity. But the value creation brought in cowboys and ruthless opportunists, who are just out to make money, whatever it takes. These people don't care about crypto and blockchain, and what it stands for. They only care about themselves.

We have enough bad people in crypto already. Three Arrows Capital had highly vocal and popular leaders, who played Pied Piper to the masses, but behind the scenes they ran their hedge fund like a Ponzi scheme. Those same masses have now lost billions that they thought were safe in cryto banks. People in crypto deserve an industry where not everything is smoke and mirrors, and where they can trust other people's integrity.

We must demand change.

Cornell University

Emin Gün Sirer has traded relentlessly on his "professor at Cornell" status, using

Cornell's brand to convince the masses that he primarily cares about the advancement

of blockchain science and has special technical skills.

In fact, his real modus operandi is more Professor Moriarty, who tries to get Ava Labs and

Avalanche ahead through clandestine attacks on competitors that

involve secretly weaponizing the legal system, as well as the pursuit of personal vendettas.

Cornell must decide whether it wants its reputation wielded for profit by

someone who seemingly operates without a moral compass.

He uses their brand to cloak himself, which directly supports his deceptive self-promotion,

and masks his Machiavellian schemes, which damages individuals and their families and the

wider crypto and blockchain community and industry.

Cornell will not want to be part of this charade.

Here is Emin's pinned tweet, which reflects how he has branded himself since launching Ava Labs and Avalanche:

So many academics forget that our goal, as a profession, is *not* to publish papers. It's to change the world.

— Emin Gün Sirer🔺 (@el33th4xor) May 23, 2018

Andreessen Horowitz and Polychain

In the realm of traditonal startup companies, venture capitalists used to only

invest in one project in each segment, so that they were never exposed to the conflict

of interest involved in backing competing companies.

Crypto changed all of that, with some venture capitalists investing widely into

native blockchain tokens, seeing that a rising tide was "floating all boats," and to make sure

they had holdings in the few that would make it big.

Now the check has come due, and with the release of this report, some will

now find that they have unknowingly funded a project making unacceptable, clandestine,

industry-damaging and clearly immoral attacks on competitive projects that they

also backed (for example, both Andreessen Horowitz and

Polychain recently threw massive resources behind Solana Labs, a key target of

Roche Freedman and Ava Labs).

They must now do the honorable thing, and help protect the industry and projects that have made

them so much money, by vocally disowning Ava Labs.

Lawyers working for Roche Freedman

The legal system is a fundamental pillar of any democratic society, and its integrity is

something we must cherish and protect.

But Roche Freedman has perverted the role of a law firm, subverting and weaponizing

the legal system thereby promoting the value of blockchain tokens and stock owned by a few of its

partners.

It undermines everything that makes the legal profession honorable.

Lawyers working at Roche Freedman who were previously unaware of this behavior will

not wish to condone it, accept a leader that lacks a moral compass, or work for a law

firm with a hidden purpose.

Most lawyers do not go through law school to end up living "Better Call Saul."

The American Bar Association

The mission statement of The American Bar Association is: "to serve equally our members,

our profession and the public by defending liberty and delivering justice as the national representative

of the legal profession."

They advocate for the profession as a whole, and the thousands of lawyers who work

with integrity within society's understanding of what being a lawyer entails.

The ABA works to "increase public understanding of and respect for the rule of law, the legal process, and

the role of the legal profession."

This is entirely incompatible with defending those people who have decided to follow "a

completely different way then being a lawyer," by weaponizing and perverting the legal system for personal gain,

which is also an assault on liberty and justice.

American Regulators (SEC, CFTC...)

Roche Freedman and Ava Labs are attemping to make fools out of regulators.

Through their nefarious weaponization of the legal system, they wish to manipulate regulators

by drawing them to competitors, and away from their own activities.

This behavior will undermine everyone's faith in the fairness of the regulatory system.

Good actors will fear that unscrupulous competitors have bought unscrupulous lawyers

using hundreds of millions of dollars worth of crypto assets, and that they are misusing

the regulatory system to paint them as targets for regulators, both to harm them,

and distract regulators from their own wrongdoings.

Ava Labs shareholders and executives

According to the evidence shared in this case study, Emin Gün Sirer has used company

resources to pursue his personal vendettas, which may now result in reprisals that

directly undermine shareholder value.

This is a clear breach of fiduciary duty.

When any leader runs out of control in this way, it is time for them to go.

For example, John Wu, the President, could be made CEO, and Emin Gün Sirer could be

removed from his post to restore confidence.

This will enable the organization to reset its reputation and proceed in a more

business-like manner.

Developers building on Avalanche

Once upon a time, those driving the blockchain project were pursuing dreams.

They met and discussed designs, they cooperated and collaborated, and they were passionate

about what was possible.

But it wasn't long before the opportunists came hunting, and they learned how to

dress themselves in the clothes of those they joined.

There are many projects in the blockchain space today, which often have dramatically

different visions and approaches to R&D and marketing.

Some also have different moral compasses.

Tech has always been highly competitive, but the winners do not generally compromise

their integrity.

When the smoke eventually clears, it will be seen that authenticity and passion

really count.

Developers will prefer to work on a platform where they can be proud of the team,

ecosystem and ethos.

Those that wish to stay with Avalanche will demand change.

The crypto press

Most participants in the blockchain industry do not realize quite how focused the

crypto press is on promoting vested interests.

It may come as a surprise to many that not only did the crypto press fail to report

on our previous cases (see Case #1 and Case #2)

but some parts actively suppressed information about them.

For example, to address the lack of reporting, we recently attempted to purchase a paid

press release on Cointelegraph, as others do, but were mysteriously blocked, presumably to protect

those our cases reference.

Meanwhile, Roche Freedman were able to purchase a paid press release on Cointelegraph freely,

which they then used to distribute misleading

statements to millions of users through Google news feeds.

Our revealing exposé of Arkham Intelligence (Case #2) was not reported on at all by the crypto press. The exposé has led to a defamation lawsuit being filed against Arkham and the New York Times, but this has only been reported on in the mainstream press by Politico . Today, DeFi and CeFi organizations once lauded unquestioningly by the crypto press have caused multi-billion dollar losses to retail investors, and it is time to move on towards fairer plains. This is the only way our industry will ever reach maturity. We ask the crypto press to report objectively on this case investigation. The videos speak for themselves and tell a clear story that everyone in crypto needs to be aware of.

Those being sued by Roche Freedman

With the release of Crypto Leaks Case #3, those being sued by Roche Freedman know the true measure of their adversary.

They should respond accordingly, and take the fight to the enemy.

They should not settle.

They must fight their corner and make their case.

Together they can weaken their adversary, and can help make blockchain a better place.

Read more case investigations...

We show the public what goes on behind the scenes in crypto. If you can help, please become a whistleblower.