Key findings

- Sam Bankman-Fried was losing money from early-on, and his claims about profitability were part of a confidence trick.

- Sam stole assets from customers of his FTX crypto exchange and applied them in a highly-calculated empire-building effort, which included extensive influence peddling with the press, regulators and politicians.

- He adopted an illegal "net equity" model, in which he took customer assets from his FTX cryto exchange, aiming to cover the hole by making other holdings and investments appreciate through his schemes.

- Sam regularly manipulated the prices of tokens, with the purpose of inflating the value of assets and holdings that he planned would fill the hole. He also crashed the value of tokens from competitive projects threatening to disrupt his holdings.

- The FTT token, created by the FTX exchange itself, was the most heavily manipulated "Sam coin," but his holdings in the Solana ecosystem, while not so directly controlled, also played the role of Sam coins.

- Sam was a highly Machieavellian actor, inteferring with the press, regulators, politicians and democratic elections in America.

- Sam was able to play Pied Piper to Silicon Valley, which was entranced by his empire-building and influence-peddling, while being unaware of the source of his funds.

- Our article begins with video of a converstion with the Head of Settlements at FTX, providing insight into goings-on.

Our spy videos: This report shares extensive spy video. All video has been collected in accordance with applicable laws.

Whistleblower appeal: With these disclosures, we aim to show people who are not crypto insiders what goes on behind the scenes. Do you want to be part of this movement? If you have any further information on this case and the different parties involved, become a whistleblower for Crypto Leaks.

Ambition beyond theft

In this case, we will explore the nature of Sam's aims, and the underlying drivers of various nefarious behaviors. We will relate this to problematic ways in which parts of the crypto industry have come to work.

This is partly an opinion piece, based on deep knowledge of the crypto industry. We start by sharing some highly insightful new spy video, which helps provide the broad tenor of what was happening at Alameda Research and FTX, which formed the core of Sam's empire.

The Head of Settlements at FTX

We talked to Lynn Nguyen, who was the former Head of Settlements at FTX US from October 2021, until bankruptcy, Settlement Manager at Alameda Research, from December 2020 to October 2021, and part of Trade Operatons at FalconX, from September 2019 to November 2020, a crypto brokerage used to sell large volumes of the Solana blockchain's native SOL token.

Those caught on spy video in earlier cases have often been involved in serious wrongdoing, but we have no reason to believe that Lynn has done anything wrong, other than perhaps staying around when the pong of dishonest behavior inside Sam's empire became too strong. We wish her well and hope she enjoys her cameo on Crypto Leaks.

With that in mind, let's dive into the fascinating conversation, recorded just after Sam was arrested.

FTX was involved in price manipulation

Lynn first talks about what happened to the Waves token, which Alameda Research reportedly

manipulated with the help of FTX.

| “ | I think that the very wrong thing to do here is that we have a prop trading firm with access to the exchange, that can control the pricing of the token |

We've all already heard from prosecutors how Alameda could rely on magical features on the

FTX exchange, and could perhaps even sell phantom tokens on markets to drive prices down,

but it's still shocking to hear it from an insider.

| “ | ...please don't bring it, like, please don't tell journalists or anyone-- but no, Alameda could pretty much do anything it wanted ... with Alameda, they can-- they have no margin, they can go as much as they want, they can launch or charge you whatever they want ... and that costs billions of dollars ... It's all supply-demand right? So, they can just much supply there, and then if no one's buying it, or like, if they decide to evaluate... any... any trade of like, short or long tokens, then yes, there is a lot of market manipulation going on. |

We fish for information about Case #1

In our Case #1, we raised troubling concerns that Sam

Bankman-Fried might have been involved in the multi-billion dollar price manipulation of ICP,

the governance token of the Internet Computer blockchain, which aims to provide a disruptive

"World Computer" that allows blockchain to act as a "crypto cloud" that can host Web3.

Specifically, we revealed that ICP-PERP, a perpetual futures instrument that was introduced by FTX just

4 days before the network launched, was apparently used

to manipulate the ICP price, in order to defend his interests in the Solana ecosystem.

| “ | Oh, it's just market manipulation. |

A key purpose of FTX was to promote Solana

Financial exchanges are meant to play an impartial role within free market economies,

providing a platform where the invisible hand of the markets can do their work,

choosing winners and losers, and fairly allocating capital.

This was not remotely the case with FTX.

It was focused on promoting Solana and its ecosystem,

in which Sam and his partners had invested billions, as well as coins

Sam had built on Solana.

| “ | Like, there was a lot of promotion... this around, so like, every time we throw an event, we also like, sponsor them with like "Oh, let's like, have this Solana' -- I forgot what's the name" |

FTX used Alameda Research to damage Solana competitors

Given that FTX wished to promote the Solana ecosystem, and had given up the impartiality normally

associated with financial exchanges, it's hardly surprising that they would also attack

those that might compete with Solana.

| “ | Well, by not promoting you, it's already an issue. But they can use the prop trading of... Alameda. |

SBF says that FTX.US is solvent to escape US authorities

Shortly before FTX.com declared bankrupcy, it transferred hundreds of millions of dollars in assets it

held to FTX.US, its United States subsidiary. This effectively transferred vast wealth out of the treasury

of its international customers, into the treasury of its US customers. But why? The obvious answer is

that he was desperate to keep FTX.US from insolvency at the expense of his

international customers, so that he might avoid the wrath of US regulators and the US legal system.

(This doesn't seem to have worked!)

| “ | The reason-- literally, please, like, please don't ever bring that to anyone, that he's been saying that FTX.US is solvent, is because then he can get out of US jurisdiction. He's not being prosecuted by the Department of Justice... the other one, FTX.com, headquartered actually in the Bahamas. So, we don't know what can happen in the Bahamas. I mean, he can pry his way out--. |

Did the Bahamas have a stake in FTX.com?

When Sam arrived in the Bahamas, he spent extravagantly. However, while he showed off an old

Toyota Corolla to the press, feeding the popular myth he was a humble

effective altruist,

he was living in a pentahouse that cost tens of millions of dollars.

His extravagance extended to massive purchases of luxury property for staff living

in the Bahamas, and huge spending on luxury hotels for staff just visting the headquarters.

Sam's spending boosted the local economy, something it seems may have helped persuade

the Bahamas government to take a stake in FTX.com.

However, the rapid expansion of FTX, followed by its implosion, probably did more

harm than good.

| “ | Also, I think the government also had some stake in the company as well. So, yes, we were the-- FTX was the enemy of Bahamas. |

Sam reigned at FTX and Alameda

A key part of Sam's defense, is that the FTX crypto exchange, and Alameda Research, his crypto hedge fund and market maker, were run as two strictly independent entities, and moreover, that he played no part in the operation of Alameda.

In our Case #1, published before the media,

crypto investors, politicians, regulators and law enforcement would even

countenance that Sam might be involved in serious wrongdoing, we drew attention to the fact that there was no

real separation, and that FTX and Alameda Research employees often appeared to inhabit the same offices,

such that they could even ask questions to each other while on calls. Lynn confirms

that there was no separation, and that Sam could see everything that was going on in both

FTX and Alameda.

| “ | Very blurred. Yes, like, Sam Bankman-Fried, he is-- knows everything that's like, went on with FTX and within Alameda, so that was-- yeah, it was - there was really no boundaries. |

How SBF happened

Sam wasn't just using his control over the Alameda Research and FTX complex to make direct profits, but also to defend his other interests. This hints that there was much more going on beneath the surface.

Sam's lightspeed journey to fame and apparent riches

November 30, 2022, Sam was scheduled to attend the New York Times' DealBook Summit, where he would have appeared alongside such luminaries as the Ukrainian president, Volodymyr Zelensky, the U.S. Treasury Secretary, Janet Yellen, and the C.E.O. of Amazon, Andy Jassy — thanks to leading New York Times journalist, and organizer, Andrew Ross Sorkin (whose long-standing dedication to the causes of Sam, are becoming increasingly relevant to the missing pieces of our Case #2 from June 2022).

Sam's in-person attendance at DealBook was disrupted by FTX being forced to file for bankruptcy, and the unraveling of his empire, a couple of weeks before. But why was Sam even there?

Sam used crypto as a giant trampoline

In 2017, Sam left his job at Jane Street, where he worked as a trader of securities, and created Alameda Research, his now infamous crypto hedge fund and market maker, which made money by trading blockchain tokens on hundreds of crypto markets around the world. He quickly came to employ nefarious trading methodologies, including market manipulation strategies that would be illegal in the traditional markets that were his alta mata, which we drew attention to in Case #1.

The crypto industry was rapidly expanding and this allowed Sam to build his personal brand, influence, and wealth at breakneck speed. When he saw that successful CeFi crypto exchanges could be incredible money-spinners, in 2019 he applied his accumulated resources and developed and launched the FTX crypto exchange, which provided a slick user experience, and operated offshore to reduce regulatory difficulties,

Alameda Research's market making was then able to provide liquidity to the markets on FTX, playing the role of counterparty in customer trades — solving a key chicken-and-egg problem that new exchanges face — while the exchange offered customers extreme leverage, derivative products, and other risky features, which also helped draw transaction volume and popularity among traders.

As FTX began to rise, and spent heavily on marketing and sponsorships, Sam became a superstar of crypto, feted inside and out of the industry.

The world assumed Sam was making money, but was he?

Strange as it might sound, however, Sam lacked the funds to pursue his grander schemes, which we shall get to.

The profits of Alameda Research were constrained by the competitive nature of crypto trading, and some trades were blowing up in their faces. Alameda Research may well have been losing money from 2019, or earlier, and soon FTX began to lose money too. Meanwhile, in pursuit of his schemes, Sam was directing increasing amounts of money into illiquid investments and influence peddling, in an epic empire building effort.

It's not difficult to understand why FTX might have been losing money in hindsight. FTX was optimizing for growth, and charged customers extremely low trading fees, while spending heavily in areas such as marketing. For example, Sam committed to spend more than $900 million on sponsoring people and buildings like the FTX Arena. This left him heavily dependent on inbound investments for cash, which came from leading venture capitalists, such as Sequoia Capital, hedge funds, such as Softbank, celebrities, such as Tom Brady, and sovereign wealth funds, such as Temasek, with at least $1.8 billion eventually being received.

Trade crypto and stocks with no fees. pic.twitter.com/uwKrP287gI

— FTX App (@ftx_app) January 28, 2021

FTX may even have been partly launched using funds Alameda Research borrowed by misstating its collateral to lenders: The New York Times claims to have seen mid-2019 text messages from Rylan Salame, the Chairman of FTX Digital, to a friend, that say that Alameda Research was in trouble at that time. (November 2022, after the CoinDesk exposé, Ryan warned the Securities Commission of The Bahamas that FTX customer money might have been sent to Alameda Research, as shown by court filings, but it seems he might have known there was trouble before.)

Meanwhile, Sam was painting a very much prettier picture to his growing army of investors and fan boys, and since everybody was in agreement he was the next big Silicon Valley wunderkind, nobody really dug in very deeply, although a few leading venture capitalists such as Andreessen Horowitz did decline to invest in FTX on due dilligence issues. Early investor Chris McCann, a partner at Race Capital, bought the party line and became starry eyed in June 2022, saying:

| “ | “They've basically been profitable from day one — and not just a little bit, but extremely — which has always put them in this upper-handed position in the market.” |

In the following video, broadcast July 2021, Sam extols how profitable FTX, and he talks about his M&A plans (i.e. his plans to buy other valuable busineses because he was doing so well) — sadly for investors, what he was doing was projecting strength, in a basic confidence trick, which strategy he pursued in many different ways, for example, by later making a fake offer to contribute billions of dollars to Elon Musk's purchase of Twitter, which he couldn't remotely afford. Sam lied to deceive, but also portrayed what everybody expected, which was the next wunderkind, making him easier to believe.

Such was the confidence he gained, as his downfall unfolded, few could believe the nature of the situation. Neither could many believe that a prominent advocate of effective altruism could really be a villain in camouflage.

Sam also joined Yahoo Finance today, to talk about his plans for FTX after the recent $900 million raise, "We're just going to continue charging forward"pic.twitter.com/ZBCF62NcWp

— FTX (@FTX_Official) July 21, 2021

Using a "banking model" to access customer assets

The colossal marketing spend of FTX, which was funded by investors, and later, partly by customer assets, was not making the exchange profitable, but it was enabling Sam to attract very large numbers of new customers. The value of customer deposits grew into the billions.

FTX customer deposits provided an enormous source of funds that he could potentially draw upon, without having to reveal his real financial situation by raising funds from investors publicly — which could undermine customer trust, and his image generally, and jeoardize his ability to align insitutional investors behind him and raise money.

Describing what happened as “a run on the bank” is deceptive since FTX was not a bank. Banks have the right to lend customer deposits; FTX did not. Customers kept those deposits for one purpose only: to trade. Appropriating those funds crossed the brightest of all red lines.

— David Sacks (@DavidSacks) November 24, 2022

As David Sacks notes, Sam decided that FTX was like a bank, and he could access customer deposits, and use them for his own purposes. Sam treated customer assets as fungible with each other, and decided that so long as he could replace them with other assets that had a similar face value on markets, that he could use them as he wished. He then used customer assets (other people's money) to become a king-maker in the crypto industry.

This appears to contradict the terms and conditions of the exchange. Furthermore, FTX customers had no idea that their assets were being used in this way:

16/82

— Adam Cochran (adamscochran.eth) (@adamscochran) November 16, 2022

FTX's terms of service expressly require that you retain title to your assets, which means, if they use them for any purpose other than what you direct them to, it's legally theft. pic.twitter.com/BxHWPUgcjk

Self-issued "Samcoins" are used as a siphon

With his imagined bank model in hand, Sam still had the problem of "net equity." To take possession of customer assets, and use them in crypto trading, or sell them and invest the proceeds into his empire building, Sam needed to replace them with other assets, which would allow him to claim that the "net equity" being held on behalf of customers remained the same at all times. The solution came in the form of tokens created by FTX itself, and others whose value he promoted, often referred to as "Samcoins," whose market price he could control.

In Sam's plan, his investment of FTX customer assets would drive the value of his Samcoins, in ways that would ensure the increase in value exceeded what he took, such that at all times he had sufficient net equity to repay deposited assets on demand. (However, they weren't his assets to risk, and the plan didn't work.)

One such Samcoin was the FTT token, which FTX claimed was valuable because it would use a proportion of the future trading fees it collected to purchase them from crypto markets and then burn them to increase their price, which Sam later compared to the stock buyback process employed by many American corporations.

By minting new Samcoins (i.e. by creating additional Samcoins that were added to the Alameda Research and FTX treasuries) and support their price on crypto markets using market making and plain price manipulation (Alameda Research benefited from special backdoor access to FTX and unlimited leverage, which made price manipulation far easier), and generally backing and promoting Samcoins using his public reputation and profile, Sam created apparent value from thin air that he could swap for FTX customer assets, then extracting them with the false justification that the net equity he was maintaining for customers remained at par.

...Excited to announce that the first FTT buy and burn is about to start!

— SBF (@SBF_FTX) July 29, 2019

Over the next three days we'll be buying and burning over 500,000 FTT, the first of many burns to come.https://t.co/8dBTfUJNDw

We bought and burned 9.31 million USD worth of FTT, one of our largest ever!

— FTX (@FTX_Official) November 16, 2021

🔥🔥🔥🔥🔥https://t.co/1fCYVc7uao pic.twitter.com/4w6QjY5lCT

Taking customer assets without their knowledge and consent, and trying to maintain the net equity value of a different set of highly volatile crypto assets maintained on their behalf, is illegal, and ultimately always doomed, since the prices of different assets move on different trajectories, and their values can easily diverge, leaving insufficient value available to re-purchase assets that customers originally deposited when they want to withdraw. The situation was compounded by the value of Samcoins being highly artificial, and depending upon his ability to control their supply and manipulate their price.

If customers requested to withdraw deposited assets such as bitcoin in significant numbers, and Sam was forced to sell his Samcoins to re-purchase the bitcoin, the price of the Samcoins would collapse, destroying the net equity he held on behalf of customers, leaving him unable to repay them. This was because their market price depended upon Sam holding a large portion of their supply, and the ability of Alameda Research and FTX to support their price on markets when needed by purchasing them, which they could not easily do if they needed to sell large numbers.

Sam disguised what was happening, by having FTX lend customer assets to Alameda Research, which supplied the Samcoins as collateral. But in practice, he was just swapping customer assets that he wanted for Samcoins, and lying about what he was doing.

Guessing the legal defense for this would be technically, they didn't *invest* client funds so this is not *technically* fraud.

— Jason Choi (@mrjasonchoi) November 9, 2022

Tweet didn't say anything about lending assets to an entity that invested recklessly and that posted FTT as collateral pic.twitter.com/5b1HcVg0pq

Sam was long aware of the risk of Samcoins collapsing in value, which would destroy the illusion of net equity. Hints can be found in an under reported but unusually candid tweet from 2020.

agreed until the last part --- it would *definitely* not be profitable for us if FTT crashed :P

— SBF (@SBF_FTX) October 10, 2020

To defend this house of cards, Sam was ferocious in his defence of Samcoins, because he knew if their value crashed, he would come undone. When Binance became aware of the Alameda Research balance sheet after CoinDesk's November 2022 exposé article, and publicly stated it would sell the large number of FTT tokens it had received as payment from Sam when he bought out their stake in FTX, Sam instructed Caroline Ellison, the CEO of Alameda Research, to mount a defence by claiming that they would buy all the FTT back to maintain market confidence.

...As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

@cz_binance if you're looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!

— Caroline (@carolinecapital) November 6, 2022

Sam was swapping valuable customer assets for Samcoins, and then using the funds to support the price of Samcoins, both directly, by buying them on markets to drive the price up, or by buying and selling them to create volume and attract cryto traders, and indirectly, through influence peddling, which maintained his social status and ability to promote them, and by investing into their ecosystems, resulting in splashy publicity, and by maintaining malign influence over the press, and social media through bot farms and other techniques.

Sam's behavior extended not just to taking public actions to support the value of Samcoin's, but also, to defending Samcoins from perceived threats and competition.

When Ian Allison of CoinDesk revealed how Alameda Research and FTX were intertwinned in his November 2022 exposé, and Alameda Research's balance sheet indicated how they may have provided FTX with Samcoins as collateral in order to borrow billions of dollars worth of its customers' assets, which Sam might have used for his own purposes, social media started buzzing and panicked customers began demanding their assets back from FTX in a "run on the exchange," and Sam's downfall began.

Matt Levine at Bloomberg began digging into the nature of the Samcoin collateral Sam was holding for customers, soon after the CoinDesk article.

Solana's SOL token was used as a proxy Samcoin

This was particularly relevant with respect to the Solana blockchain. In 2020, Sam acquired a large part of the supply of the Solana's SOL token, in deals that remain cloaked in mystery, and then committed to using his financial power and control over the industry to drive its ecosystem. While its native token SOL is not a pure Samcoin in the mould of FTT, there are similarities in the way its value also depended on the Alameda/FTX complex, and the support of Sam and the bandwagon of venture capital supporters he brought along, as we explore later.

SOL came to play the role of a Samcoin. While he didn't create the Solana ecosystem itself, he could use his stolen capital and influence to drive the value of the blockchain and its SOL token, as well as tokens from its ecosystem, which included full Samcoin projects such as Serum — and therefore they played a near identical role within his portflio. Sam needed SOL to continually increase in price to replace the FTX customer assets that he was taking.

Sam was investing FTX customer assets into the SOL ecosystem, and other channels that he needed to maintain his influence and promote the blockchain. For example, he was investing massive amounts of money into Solana startups, gaining highly illiquid (hard to sell) stock in return. He needed his investments into Solana to increase the value of SOL to replace what he was stealing. For such reasons, early on he made similar statements in defense of SOL, that Caroline had made in defense of FTT:

I'll buy as much SOL has you have, right now, at $3.

— SBF (@SBF_FTX) January 9, 2021

Sell me all you want.

Then go fuck off.

Riding high, despite suspicions relating to ICP and Solana

Despite the evidence presented in our Case #1 of June 2022, Sam mania continued and grew. Soon after he was being presented as the JP Morgan of crypto — comparing him to a man who saved the American financial system from the great market panic of 1907 — across both the mainstream and crypto media, with only a few cynical dissenting voices pointing out the major discrepancies between the popular mythology and the facts.

Weeks before crypto twitter exposed the FTX fraud, Andrew Ross Sorkin was on CNBC calling SBF the “JP Morgan of crypto.” No shame pic.twitter.com/rrPh4twkWt

— Nick Tomaino (@NTmoney) November 25, 2022

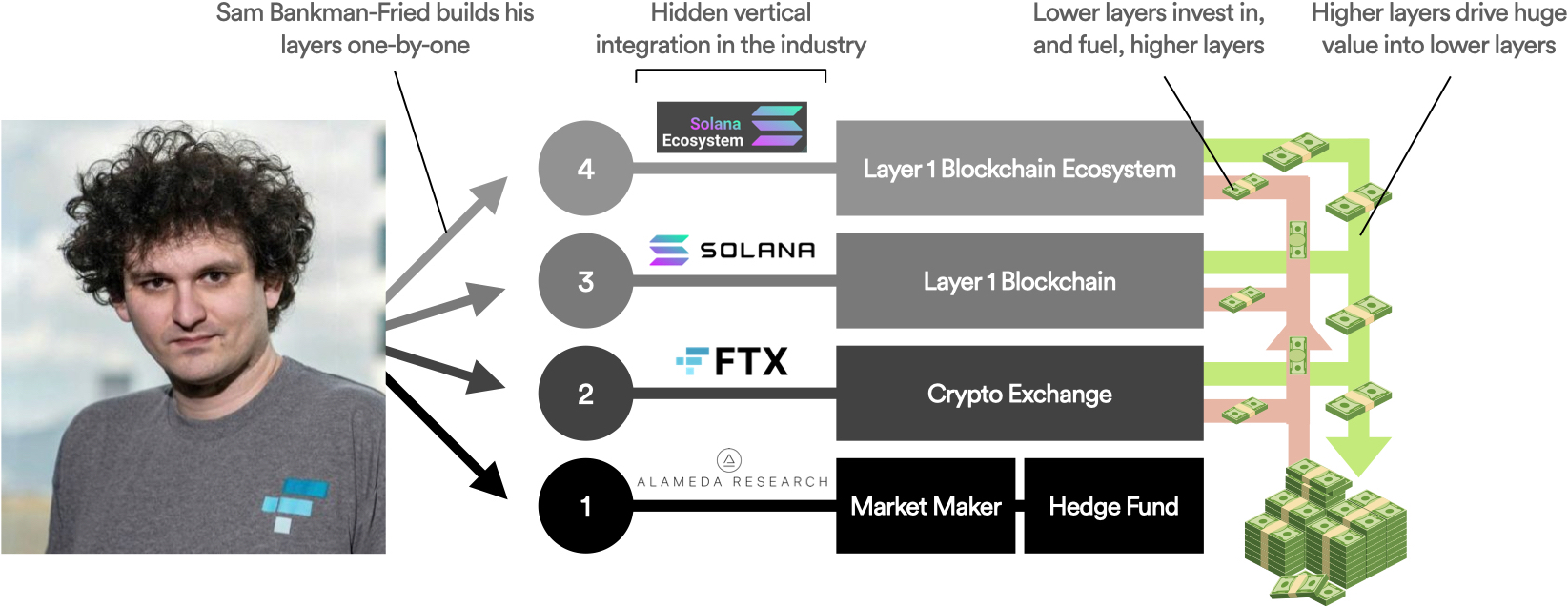

While Sam was being widely beatified, our Case #1 drew attention to the apparent vertical integration between FTX, Alameda Research, Solana and the Solana ecosystem, diagramming something that looked like a flywheel.

This was an over simplification, but correct in many important respects. Sadly we missed that Sam was not only driving his chosen ecosystem using unfair trading profits generated by Alameda Research, but also massively funding it using assets he was stealing from FTX customers. The realities of the situation meant that if the rise of Solana and its SOL token was disrupted, reducing their ability to replace FTX customer assets, and their utility as collateral, Sam knew this might lay a direct path to jail.

He was incentivized to pull out all the stops attacking people and projects that might disrupt SOL to protect his personal freedom. Accordingly, the core hypothesis of Case #1, that he might have been responsible for the massive price manipulation of the Internet Computer's ICP token when it launched, which occurred on FTX using an instrument he created days before called ICP-PERP, looks even more compelling.

Sam could have shared the trading records of ICP-PERP, which was used to manipulate the initial price on FTX, or issued a statement as requested, to dispell suspicions, but he has failed to do so.

Andrew Ross Sorkin has also been asked by several parties to deny that he promoted the crooked "Arkham ICP Report" covered in Case #2, which bolstered the attack, on behalf of Sam Bankman-Fried, and has failed to do so.

In the Appendix: how venture and institutional capital spun the Solana flywheel.

Whistleblower Appeal: Do you have information that you can share with us, regarding links between Andrew Ross Sorkin and Sam. Please become a whistleblower for Crypto Leaks and support the honest crypto community.

Master of crypto flywheels, and evil Icarus

Sam plugged into a modern, and highly sophisticated version, of an old game in crypto, then took it further. He wasn't a technical genius, and he wasn't a financial genius, but the capital he stole, combined with his ability to promote, manipulate, deceive, and manoeuvre in Machieavellian ways, made him a genius at what he really did. His brilliance at the game is a lesson to the crypto industry.

Blockchains are best understood as decentralized economic ecosystems. A mathematical network protocol provides the foundations, but the overall ecosystem it supports can be revved up in many ways that can have little to do with underlying technology.

The Appendix explains how blockchains are ecosystems, not enterprises.

Blockchain ecosystems depend on the maintenance of belief among many different kinds of participant, and the markets that allow the liquidity to flow among them to support their economy. They are stimulated by new entrants, people building on them, whether they are paid to build, or do so organically, announcements that are interpreted as demonstrating progress, and increases in the liquidity and price of their native tokens. Those that can generate these effects, can become masters of the flywheels involved, and crypto warlords.

Sam joined other crypto warlords at the top table

The prop trading and market making of Alameda Research, gave Sam resources, and the ability to exert very significant influence over token prices, to the extent that by September 2019, he was being accused of manipulating the global price of bitcoin, leading to legal action against him, that he appears to have paid to go away, as reported in Case #1.

A market maker from a smaller futures exchange tried to attack @binance futures platform. NO ONE was liquidated, as we use the index price (not futures prices) for liquidations (our innovation). Only the attacker lost a bunch of money, and that was that. pic.twitter.com/ztMZEtYKc6

— CZ 🔶 Binance (@cz_binance) September 16, 2019

Sam's power placed him at the top table with other crypto warlords, and he gained membership of the Digital Currency Group's exclusive "HQ," which provided "family office" wealth management, conceirge and fixer functionality to elite crypto power players (in the aftermath of Sam's downfall, and with Digital Currency Group facing problems of its own, HQ has recently been disbanded). Through his membership of an elite virtual club of crypto power brokers, he was able to extend his influence and reach even further on his way to dominating crypto.

Sam becomes Warlord No. 1 by wielding Silicon Valley

Rather than himself to Silicon Valley as a geeky warlord, pulling strings in crypto from the shadows, he presented himself more like the next Mark Zuckerberg. Silicon Valley wanted a champion of its own to maintain its hegemony in Web3, and Sam was its own elite progeny. Sam went to MIT, both his parents were Law professors at Stanford University, and he spoke in a "geeky genius" style reminiscent of Vitalik Buterin. Meanwhile, not only did the young man appear to have all the answers, but he was apparently a financial genius, who seemed to be able to conjure money out of thin air, and was an effective altruist to boot.

FTX founder @SBF_FTX lives his life by a calculus of altruistic impact. pic.twitter.com/IyBUhT2Snz

— Sequoia Capital (@sequoia) September 30, 2022

Sam also round-tripped FTX customer funds into venture capital firms that supported him to strengthen their relationship. (There is no suggestion any of them where aware of the situation.)

The Information Scoop: FTX's Sam Bankman-Fried quietly invested in Sequoia and Paradigm funds while also raising money from those same firms.https://t.co/yfHlKgJPbA

— The Information (@theinformation) November 10, 2022

Money is power, Sam had it all, and he used it to corrupt

The true extent of Sam's investments of stolen FTX customer money into the crypto ecosystem took place on a scale that is hard to comprehend, totaling more than $5 billion. Venture and institutional capital tagged along with gusto, multiplying the enormous amount of funds he was able to direct into his flywheel causes in the crypto ecosystem.

Because I'm incredibly autistic, I exported all the Alameda investments (more than 470!) from the FT piece. The total amount invested is roughly $5.3 billion.

— Larry Cermak (@lawmaster) December 6, 2022

The largest investments are:

1) Genesis Digital Assets

2) Anthropic

3) Digital Assets DA AG

4) K5

5) IEX pic.twitter.com/bWVKuLLawG

The above tweet links to a spreadsheet containing the list of Sam's known investments. Note this appears demonstrably incomplete, since it does not contain entries for the various formally-disclosed holdings of SOL that Sam acquired from Solana Labs and the Solana Foundation.

The list shows that Sam invested into different sectors within crypto, which he did not just to spread his risk, but to spread his influence. Those who were not on "Team Sam" could face being shut out of the industry.

Meanwhile, Sam's blessing meant ascension. Brad Nickel, who hosts the crypto podcast “Mission: DeFi,” said:

| “ | For a start-up to get money from Alameda meant everyone else would follow along ... There's no due diligence or anything ... If you took money from Alameda, you could get a lot of big-name investors in. |

Tokens provided a way for venture capitalists to release early liquidity from their investments, something that changed their investment calculus.

Paying media, schmoozing government & election interference

Many in the press, particularly in the media, were drawn to Sam not just by the mythology, but by his support for their causes. He is accused of making more than $100 million in political donations in total. Sam masterfully played all sides for fools, at one point stating that he would donate $1 billion dollars to help keep Donald Trump from office, when he did not have the means to do so.

The New York Times became unwavering in its support for Sam. Now the media, regulators and government would be drawn into the web that Sam used to nurture and defend crypto flywheels, and realize his ambition to transcend the industry.

Crypto's master manipulator was now on the loose in the wider world.

The funds Sam stole from FTX customers allowed him to spread his corruption across the world like a cancer. Normally such powerful figures draw the attention of investigative journalists. But to dissuade them from looking into him too closely, he donated to numerous investigative publications:

I wrote earlier today that there's a huge question over whether SBF will be able to continue funding media going forward.

— Teddy Schleifer (@teddyschleifer) November 11, 2022

Grants have gone to:

— ProPublica

— Vox

— The Intercept

— Semafor

— The Law and Justice Journalism Project

— A podcasthttps://t.co/hqeislc8fr https://t.co/cPT1geNoGw

Within crypto, he was more direct, sometimes handing out millions of dollars to the executives of key publications from which he needed support. For example, Sam lent The Block $27 million for operations, and $16 million to its CEO, Michael McCaffrey, which he used to purchase luxury property in the Bahamas. But this was hardly necessary — many publications, industry research groups, websites and media outlets, in which he simply held stakes, or which were owned by related parties, anyway showed clear patterns of support for his campaigns, supporting projects in which he was invested, and either ignoring, or actively spreading disinformation about, projects that threatened his interests.

The support of mainstream media, such as the New York Times, derived primarily from his support for political causes, his relentless spending on PR and self-promotion, and their starry-eyed desire to cultivate connections with the emerging wunderkind star. But even here, it is likely that additional influence was brought to bear through bona fide commercial relationships. For example, the FTX creditor list includes the New York Times, for reasons as yet unknown.

As Sam's public beatification gained momentum, he was entertained in the White House by senior aides to Joe Biden, the US President, and gained in-person access to regulators involved with crypto.

Months before FTX collapsed, SBF met with Gensler to discuss a new SEC-approved crypto trading platform.

— DeFi Pulse (@defipulse) November 15, 2022

If approved, SBF would have had a jump-start on the competition with a trading platform meeting SEC standards...

Sam's rising influence in government circles, access to regulators, and the support of the mainstream press, along with his professed philanthropic aims, cemented his dominant position and reputation within crypto.

I’m honored to be testifying before the House Financial Services Committee today about the future of the digital asset industry, along with colleagues from Coinbase, Circle, Paxos, Bitfury, and Stellar.https://t.co/ODB285Yuvq

— SBF (@SBF_FTX) December 8, 2021

By his downfall every third member of the United States congress had received money from him.

A detailed example of how used the funds he obtained from FTX customers and market manipulation can be seen in his interference in the Vermont lieutenant governor elections. It's not just that he sought to influence the outcome, but about he executed his plan that is remarkable, and provides insights into his mindset.

See the Appendix for the details of the lengths Sam went to when interferring with and manipulating an election to increase his influence.

APPENDIX

1. How institutional investors spun the SOL flywheel

Money flowed into Multicoin Capital

Many funds funnelled money into the Solana ecosystem, alongside Sam's own entities. One the largest was Multicoin Capital, and here we look at how it funnelled institutional capital into Solana, and the overall results.

Multicoin Capital leveraged Solana hype to persuade conservative traditional venture capitalists, such as Union Square Ventures, to invest very substantial funds with them. Most were aware that invested funds would largely be reinvested into the SOL token. This wholesale channeling of institutional funds into SOL undoubtedly drove up its market price during 2021.

Multicoin ran several funds. Their first fund delcared an extraordinary 2021, and perhaps the founders marked their gains to market, calculated multi-billion dollar gains, and liqudated SOL on the markets to pay out their bonuses in the form of cash on "carry" on calculated profits. However, two later funds also bought SOL en masse, and helped to drive up the price, but rather than liquidating near the top like the first fund, they reportedly bought more SOL, which would have helped maintain the price as the first fund sold, then taking the loss as the price of SOL began to fall.

Taking SOL to the grave

— Composability Kyle (@KyleSamani) August 30, 2021

This is an emerging story, and perhaps more color will emerge, which hints at the moral jeopardy involved when venture capitalists and hedge funds make new investments that drive financial flywheels delivering gains to their early investments.

When Sam's balance sheet was exposed in November 2022, and SOL went into freefall, many institutional investors into Multicoin Capital's funds were left nursing substantial losses: Flywheels are often a game of musical chairs, and you need to be the one sitting down when the music stops.

Many powerful players are now stuck in Solana

The Solana Foundation, which is essentially controlled by Solana Labs, a traditional for-profit corporation, revealed that more than 58M SOL had been sold to entities directly owned by Sam, which is 15% of even today's growing circulating supply, and this number fails to capture the true scale of holdings of the entities related to Sam. Meanwhile, the importance of Alameda Research and FTX to the Solana project, and the scale of the early holdings they had acquired, was often being denied.

Calling Alameda an insider is pretty disingenuous

— Composability Kyle (@KyleSamani) November 22, 2021

I don’t think Sam even knew that Solana existed until the token was already trading

Meanwhile, even Sam's large proven SOL holdings only hint at the true centralization of the SOL supply among a tight-knit group of power players.

For example, another giant market maker, which also turned tricks as a hedge fund by investing into Solana, was Jump Trading Crypto. It was so heavily invested into Solana, in an amount of SOL and other ecosystem tokens we do not know, that when Solana's centralized Wormhole bridge, which connects Solana to Ethereum, was hacked, they backstopped the $320M loss themselves in order to prevent the wrapped assets the bridge created from losing their value, which would have been catastrophic for the Solana DeFi ecosystem (no doubt the backroom machinations that led to Jump Trading Crypto taking one of the team would make a fascinating story).

Jump Crypto recapitalized the contract with 120k ETH to ensure that all Wormhole-wrapped Ether on every chain is fully backed.

— Wormhole🌪 (@wormholecrypto) February 4, 2022

4/

Yet more SOL is held by Solana Labs, providing additional indirect holdings to investors in its stock, which include Sam entities (reflecting how their real holdings exceed 15% of the token supply), venture capitalists, and the project founders, who also hold much more SOL directly. Further, many venture capitalists who tagged along also hold SOL directly, and of course, there is MultiCoin Capital, and our bet is that other large holders will emerge. Meanwhile, we can take it as a given that the Solana Foundation also holds large amounts of SOL in its treasury.

Therefore, it would not be surprising to us if 35-50%+ of the SOL supply is in fact owned and controlled by a cabal of power players.

Now that the Solana flywheel has lost its luster, and the godfather-like power of Sam and his stolen money is gone, many investors are trying to work out whether their investments are sunk costs, or whether the highly wobbly underlying technology, twinned with the undeniably vibrant community, which was created by a great developer experience, plus fancy parties, conferences, and the huge level of investment into Solana projects, gives the ecosystem long-term legs, such that they should defend their previous investments rather than seeing them as sunk costs.

The danger is that as massive amounts of SOL unlocks, which was sold with aggressive vesting schedules to defend the market price, that capital will head for the exit on the markets, including the huge amounts of SOL caught up in the Alameda Research and FTX bankruptcies, and we will see a progressive unravelling that amounts to a slow "run on the token" that even the support of a powerful market maker like Jump Trading Crypto will be unable to prevent.

For Silicon Valley venture capitalists sucked into the Solana whirlpool, calculating the answer to the above question will be complicated by long-standing deceptions about Solana's technology, the size of the SOL token supply, and on-chain activity, as this thread by a popular crypto Twitter pundit describes:

1/25) Solana has been marred in controversy since its founding

— Justin Bons (@Justin_Bons) October 3, 2022

With frequent downtime, failures, hacks & scandals!

This is why I have put together a short & incomplete history of SOL's skeletons

Working our way down a colorful history of lies, fraud & dangerous trade-offs:

The Solana community has many brilliant and dedicated people, who care deeply about DeFi and Web3, but it is also the case that Solana Labs has never published formal math describing their network's protocol and workings, let alone shared security proofs, contradicting the very idea of a public blockchain network, whose math and protocols must be publicly verifiable, just like those that drive the internet itself.

What has been published, for example regarding Proof of History, on any reasonable formal analysis, appears to be complete pseudo-science, which might have been conceived as simple marketing.

Many investors remain unaware, while yet others profess that they don't care, believing that "fake it until you make it" will work, even in a field as complex as crypto, where making real breakthroughs can involve hundreds of man years of research and engineering work. Their general meme was that Sam's capital and influence, and the venture capital that followed him into the Solana ecosystem, would deliver solutions and eventual success. But as the continuous Solana outages, and ongoing failure to share math shows, things aren't that simple.

A key purpose of blockchains is "trust minimization," which is essential in a technical environment where no central party has control, and hacks cannot be easily reversed. This principle holds even if a network is heavily centralized. Claims that this might be otherwise are self-serving and irresponsible.

Why does security have to be #1 priority?

— Composability Kyle (@KyleSamani) July 23, 2021

I value speed more tbh

There are parallels with the "fake it until you make it" Theranos disaster. Here though, billions have been funnelled into crypto ecosystem investment agreements that demand developers build on a deeply flawed technical platform that will never be able to deliver what is needed — even though the publicity and excitement generated by the investments helped spin the flywheel and keep the cash flowing.

If the concerns of Case #1 prove well-founded, then the investment of so much money into a flywheel with shaky technical foundations, also led to attacks on other honest projects to defend it, which resulted in the victimization of large numbers of people.

2. Crypto networks are ecosystems, not enterprises

How crypto ecosystems form and function

Blockchains such as Bitcoin or Ethereum, are not enterprises, but ecosystems. It is for this reason that their base layer tokens, which these ecosystems produce through math, certainly do not look like securities as some in the United States are currently claiming. The reason is simple: an ecosystem is not a "common enterprise," which is what the Howey Test requires. (This does not apply to tokens whose value derives from a common enterprise, as FTT tokens derived their value from the revenues of FTX, rather than a native role within a decentralized protocol and ecosystem.)

For obvious reasons, it is much harder to create a functioning ecosystem than an enterprise. An ecosystem is formed by the choice of large numbers of independent parties. A blockchain ecosystem will, for example, typically include a core developer team, that enshrines the network's protocol in code, independent parties that run the mining rigs and nodes that use their code to form the network, then more parties that build on the network that make it a useful place to be and drive its decentralized economy, and those that join the community, helping to advocate for the network, defend it from attacks, and draw inbound enthusiasts to ensure there is sufficient activity and liquidity for the ecosystem economy to function and support all the various actors involved.

Crypto markets lie at the heart of these ecosystems, because they enable the flow of value to and between ecosystem participants. This meant Alameda Research and FTX provided Sam enormous power that he could use either lending a hand creating ecosystems, or trying to destroy ecosystems that competed with his interests.

Technology, belief and markets: the Bitcoin method

The independent actors involved in a blockchain are partly brought together by the functionality provided by its decentralized network, and partly by a belief that the network can be successful, and that therefore they should dedicate their time and resoruces to it. In it's earliest years, Bitcoin was unproven. The concept had to be evangelized, and the community developed an ideology that bound them together, which was sustained by a unwavering belief that the network would succeed. Satoshi launched Bitcoin by combining a revolutionary technical approach with a viral idea:

Satoshi Nakamoto’s first post on the Bitcoin forum (2009) pic.twitter.com/1JsKCaMgpE

— Ticker History 🗞 (@TickerHistory) November 28, 2022

The belief that was built meant there were people who contributed to the ecosystem, and would hold bitcoin, ensuring that it could provide participants with the liquidity necessary to sustain it. Bitcoin was the first ever blockchain, and the challenge Satoshi faced in building faith and momentum was far harder than for those who followed in his wake in later years.

As the ecosystem developed, its participants hung out in places like Bitcointalk, and social media became the key forum in which belief was sustained, the Satoshi ideology was evangelized, and communities tried to reach agreement on technical questions. Crypto exchanges were created, and whales with large holdings began to perform market making to ensure that people could buy and sell bitcoin without moving the price too much. Sometimes, those whales became involved in trading activities, and deliberately moved the price around to create trading profits, with the volatility ironically drawing new converts from those who wished to spin a profit.

The Bitcoin world evolved and became self-sufficient, and within that world a variety of crypto-native natives evolved. There were the idealists and true believers, the money men who wanted quick profits, the hopeless gamblers, and then people that really did use this newfangled digital gold as a currency.

Out of this melting pot, eventually came identifiable patterns and methods that could be used to launch new crypto ecosystems, or, indeed, provide one with an advantage over others.

The emergence of crypto flywhyeels, and crypto warfare

Those holding bitcoin looked for new things they could do with their tokens, and new ways to make money. Soon, people began making forks of the Bitcoin code, and proposing new cryptocurrencies, which were typically based on some trival modification to its workings. The systems and learnings involved in forming the Bitcoin ecosystem were re-used, but with a difference.

The early "altcoins" were also often what was termed "shitcoins," with little original about them, and it was recognized that they would often operate as pump-and-dump schemes. Nonetheless, teams would develop them, miners would decide to host them, markets would promise to list them, and they would be promoted on Bitcointalk. People were skeptical, but often participated in buying the tokens as a form of gambling, aiming to ride the pump, but exit before the dump. WallStreetBets style investing took place.

Arguments would occur when participants felt that insiders and whales had manipulated the markets, and scammed people out of their money. The game became adversarial.

Of the 'top' shitcoins of 2013, the only one anyone remembers today has dropped 40% next to Bitcoin since.

— Saifedean Ammous (@saifedean) May 19, 2018

It's still successfull in its real goal: enriching its maker, who sold all his shitcoin at the top.

Where will your shitcoin be in 5 years? What about its creator? https://t.co/zJC0MZPUkI

Despite most failing, some altcoins found firm ground and persisted. An example would be Dogecoin, which was created in 2013, and is still successful today. This led to people being more ambitious technically, albeit on a limited scale, for example with NXT, an early Proof-of-Stake cryptocurrency that was launched in 2014, or Mastercoin, which aimed to layer additional functionality on top of Bitcoin in 2013, but which had its own separately traded token. From this fracas, genuine innovation began to emerge.

If you REALLY took time to talk with even 10 of the CEOs who currently lead #crypto startups in the top 50 (or even 100) today, I sincerely doubt you would use the word #shitcoin in the same vein again. Yes, there are startups that fail & a few are scams, but all are not 'shit'.

— Brad Laurie (@Brad_Laurie) October 22, 2019

However, the strategies for launching genuine projects still very much bled into the strategies used to launch shitcoins, and whales still aimed to gain early stakes, or pre-mines, which they could offload at higher prices to those buying into the project. Meanwhile, the systems and strategies involved in launching and promoting new coins using social media and through cypto-focused publications, whose journalists were often incentived to promote them through token grants, became more sophisticated, and the individual projects became more adversarial. Just as there were those who hoped to profit from the price going up, soon there were those who wished to profit from the price going down, or destroy projects for competitive reasons

The alt scene therefore evolved into a battleground for resources and capital. Those supporting various projects, became like warring tribes, who were supported by those invested in their coins from behind the scenes, who often primarily cared about the financial opportunity, rather than the long-term vision of the projects, who nevertheless integrated into the community, also helping with evangelism and the reinforcement of the project's ideology to help secure its people and resources. All possible means began to be used to create gains.

This was the world that Sam stepped into, when he created Alameda Research, and it was embedded in its DNA.

Ethereum triggered Bitcoin Maximalism, and the stakes rose

For a while, the alts failed to pose any appreciable threat to the resources of the Bitcoin ecosystem, and while they were often treated by mirth by Bitcoin believers, who sometimes dabbled, they were broadly tolerated as a feature of the Wild West crypto ecosystem. The emergence of the Ethereum project in 2014 changed all of that.

Nine years ago the world said hello to #Ethereum.@VitalikButerin was 19 when he wrote these seminal words, foretelling the foundation of the decentralized future. pic.twitter.com/Stb1LrNFZu

— Nexo (@Nexo) January 24, 2023

Here was a project that genuinely introduced something new and powerful — revolutionary smart contract software that lived fully on a trustless and unstoppable blockchain, together with its computation and data — which made interesting new things possible. The white blood cells of parts of the Bitcoin community went into action, attacking the project, and Bitcoin Maximalism was born.

Bitcoin Maximalists feared Ethereum might appreciably take resources and liquidity from Bitcoin, even though arguably, in the event, it added value by allowing bitcoin to be used in DeFi. The ferocity of crypto conflict, driven by the intermingling of belief, ideology an financial interests, increased.

En masse, Bitcoin Maximalists hit social media to decry Ethereum as a fraud and scam. Meanwnile, supporters behind the scenes manipulated the crypto press to broadly exclude fair discussion of the project, which was why ConsenSys created its own publication, Decrypt.

By this time, the total market cap of the crypto industry was reaching into the many billions, and the financial stakes had become huge. Money men reached for control of key infrastructure such as crypto publications that could direct belief and financial support, which then came to represent hidden commercial interests, or became pay-to-play, since the press was seen as a common resource required by all projects, which should therefore pay to access it.

While the sales pitches of crypto projects remained idealistic, behind the scenes a cynical belief that the ends justified any means emerged. The emergence of Ethereum transformed crypto into a multi-polar battlefield without rules, which was fought on many different fronts, including social media, the press, and financial markets, as well as technology. Projects would aim to create communities that could build and sustain momentum, drawing attention and capital. Whales helped fund their communities, and to protect investments at risk, began to orchestrate dirty tricks against competitors. Now flywheels involved not just money and promotion, but attacks.

Crypto warlords make bank as their flywheels build fortunes

Scrolling forward to recent years, crypto had become a juggernaut, with many real and fantastic projects. But, the game was more dirty and cynical than ever, which was cleverly hidden beneath a very convincing veneer. Large numbers of networks worth billions were supported by powerful whales and investors, market makers, and sophisticated marketing and growth engines, while often times their technology was completely vaccuous, and lacked backing by meaningful technical teams. While their catchy-sounding value propositions were easily spun to the public, the narratives being promoted bore very little resemblence to the practical reality on the ground.

Crypto market cap growth:

— Binance (@binance) December 23, 2020

2020: $193B ➡️ $641B 📈

2021: $641B ➡️ $???? pic.twitter.com/Iu7U20Df5D

Ecosystems could be built by distributing tokens to potential ecosystem participants. Power players were given tokens at discounts to ensure their support, the crypto press would play ball, and sophisticated social media manipulation machines went to action, using thousands of bots to convince communities that they had reached consensus on points of opinion, when in fact, a hidden machine was feeding the consensus to them. Meanwhile, manipulation of token prices through market making and other means could provide what appeared to investors as concrete proof that projects were succeeding, and were moving towards achieving the lofty visions and goals that they were painting.

To the chagrin of true believers, and the technologists, the warlords became necessary power brokers, who in return for early stakes in projects, would bring their weaponry to bear, creating ecosystem flywheels that drove the value of the tokens they held. The more powerful and sophisticated their weaponry, the easier it became to get in early, to create a flywheel, and defend it against threats — such as competitors that might disrupt the narratives being spun at the heart of the flywheel, around which the social media, press, investment announcements, market manipulation, and other facets orbited.

This business model became core, rather than the creation of technology that might truly have impact on the world beyond creating volatile tokens. This is reflected by the way that most Layer 1 crypto projects consist mostly of marketing and business development people, rather than people actually researching and developing the technology, even though the field is highly challenging. Although the field is called "crypto," few projects employed even a single cryptographer.

In the world that was created, projects travel on an arc, which begins with a hype phase, with unbounded optimism, in which the markets for their tokens can become incredibly liquid, and large numbers of entrants are drawn in by token grants, investors fund developers to build on the network, and they look like the next big thing. Eventually, the weaknesses become apparent, and the excitement fades, but with the support of crypto warlords, the arc can be very broad.

Crucially though, when the timeframe is compressed, many of these projects still look like pump and dumps. The key though, is that the arcs are long enough, and the liqudity created in their tokens large enough, that the insiders, investors and warlords can exit with enormous profits. It's the same old game, just with vastly more sophistication. Moreover, now, the giant decpetion machines involved are so sophisticated, that participants can even convince themselves this is not what is happening, or claim plausible deniability.

The only way beyond this, is to create a crypto industry that is more transparent, without bot farms, market manipulation and a press that secretly promotes vested interests, which focuses on the fundamental value propositions, teams and technology i.e. flywheel masters and warlords have to go.

3. How Sam interferred in the Vermont's primary election

August 2022, the state of Vermont's lieutenant governor, Molly Gray, was a Democratic congressional candidate in the upcoming primary. In a Zoom conversations with Sam and top deputy Nishad Singh, regarding his Guarding Against Pandemics (GAP) dark money group, run by Sam's brother Gabe, Gray had bristled at the suggestion that the group had a super PAC that might spend in the race to help her win (likely seeing the true nature of their approach involved influence peddling). Naturally, Sam decided she had to go.

In a reflection of his ruthless cunning, they formed a relationship with Gray's rival, Becca Balint, who agreed to explicitly promote GAP on her website, and mostly importantly, take Sam's money. However, Gray asked Balint in a debate to declare that she would not accept outside money from a super PAC, and they realized that their financial support risked alienating the progressive electorate.

Sam funnelled more than a million dollars to his candidate, while laying a cunning trap for her opponent the same time: He sent his candidate money through a "LGBTQ Victory Fund."

A related controversy is how to respond when a SuperPAC runs an ad on a candidate's behalf. Last week the Victory Fund SuperPAC began airing $160,000 pro-Balint ad campaign. The Balint campaign rejected Gray's call for a joint press conference denouncing the ad. 7/

— Matthew Dickinson (@MattDickinson44) July 18, 2022

As Sam had hoped, Gray fell into the trap he had carefully laid, by attacking Balint, who is openly lesbian, for her use of outside super PAC funding from the LGBTQ Victory Fund.

Lt. Gov. Molly Gray’s congressional campaign is taking one last swing at state Sen. Becca Balint on issues of campaign finance ahead of Tuesday’s primary, this time accusing her chief rival of potentially illegal coordination with an outside group. #vtpolihttps://t.co/IAdb70YNPV

— VTDigger (@vtdigger) August 9, 2022

The result was that the supporters of Balint immediately began insinuating that Gray was homophobic, helping dissuade much of the progressive electorate from voting for her. Balint then won the race, and the true source of the money she received was only revealed after the election.

Sam is one of the few people alive today that might be able to write a worthy successor to The Prince.